JPMorgan forecasts fall to 0.67 early in the year

Analysts at JPMorgan think the Australian dollar will bottom early in the year at 0.6700 before recovering to 0.7200 at the end of the year. Today AUD/USD is down 20 pips to 0.7232.

"Australia's terms of trade have fallen 30% since 3Q11, a compelling drag on the currency and nominal GDP in recent years. But for 2016, we do not have a lot of shape in our forecast profile for the terms of trade, largely because we see Australia's major commodity prices as mostly range bound in the year ahead," they wrote in a client note.

On the kiwi, they see 0.59 in Q1 and a recovery to 0.61 at year end. Spot is at 0.6572.

"The risk bias to Antipodean currencies remains firmly to the downside in 2016," they write.

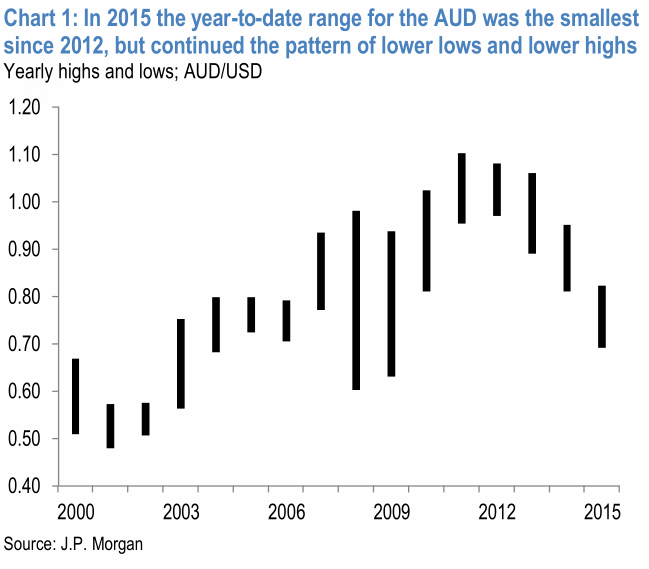

Their final theme is lower volatility in AUD/USD.

Flatter commodity prices and more certainty on domestic interest rates are the main reason. If commodity prices remain flat, AUD traders will look elsewhere for moves.

"One implication of our analysis is that at least in the short term, the AUD may exhibit a greater sensitivity to 1) interest rate differentials and 2) perceptions around the Chinese growth story in the year ahead," they write.