The Federal Open Market Committee (FOMC) of the Federal Reserve meet on December 15 and are widely expected to hike rates

But, its too early to do so argues this piece from the Wall Street Journal

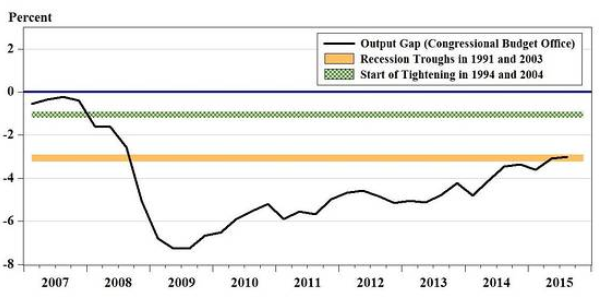

- U.S. employment remains well below its potential

- The Fed's inflation target of 2% is gauged in terms of the price index for personal consumption expenditures ... has been running around 0.2% over the past year ... even the inflation rate of "core" personal consumption expenditures has been trending downward since 2011 and stands at 1.3%

There is plenty more at the (ungated) piece.

I've been in the 'hike' camp for a while ... but this is sobering food for thought