No surprise to see the euro sitting in a tight range following the ECB meeting

I was out yesterday when Draghi started his show so I only caught up on the details after. From the posts about it I assume 'bore-fest' was the result?

Just from looking at the PA alone I can probably also assume that those intraday longs from yesterday all got out above 1.1300 and the resulting drop was also helped by broad dollar support?

That's all well and good but it's old news so where does the euro go from here?

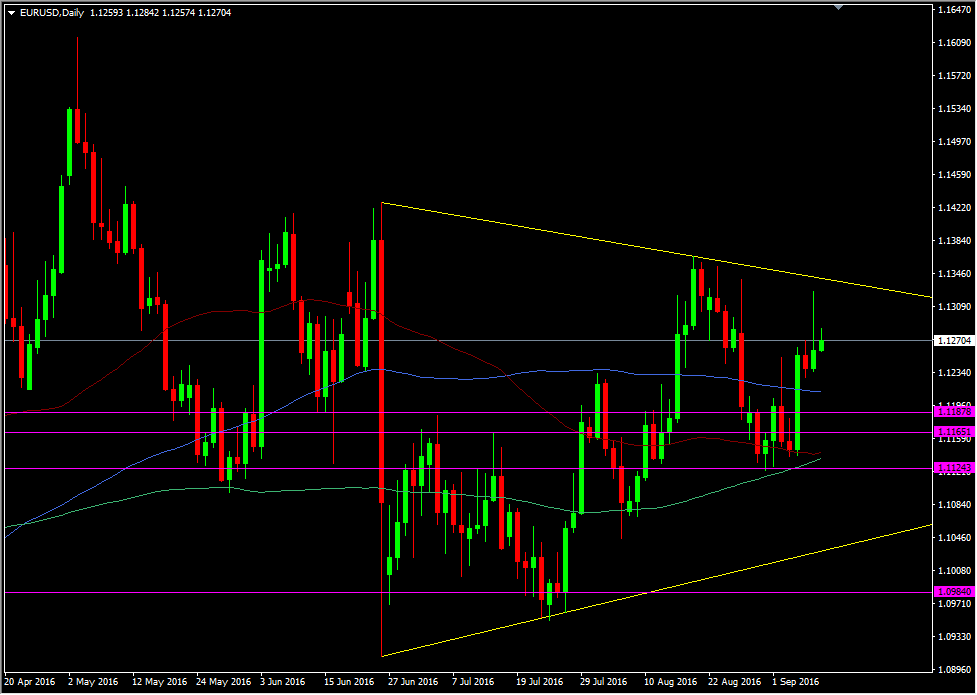

EURUSD daily chart

The topside is pretty structured with the trend line and the Mid-Aug highs.

Underneath, the 100 dma could well act as decent support should we move down through recent lows. Those recent lows coincide with the 100 H4 ma so there's a decent amount of tech to lean on down to the 1.12 big figure.

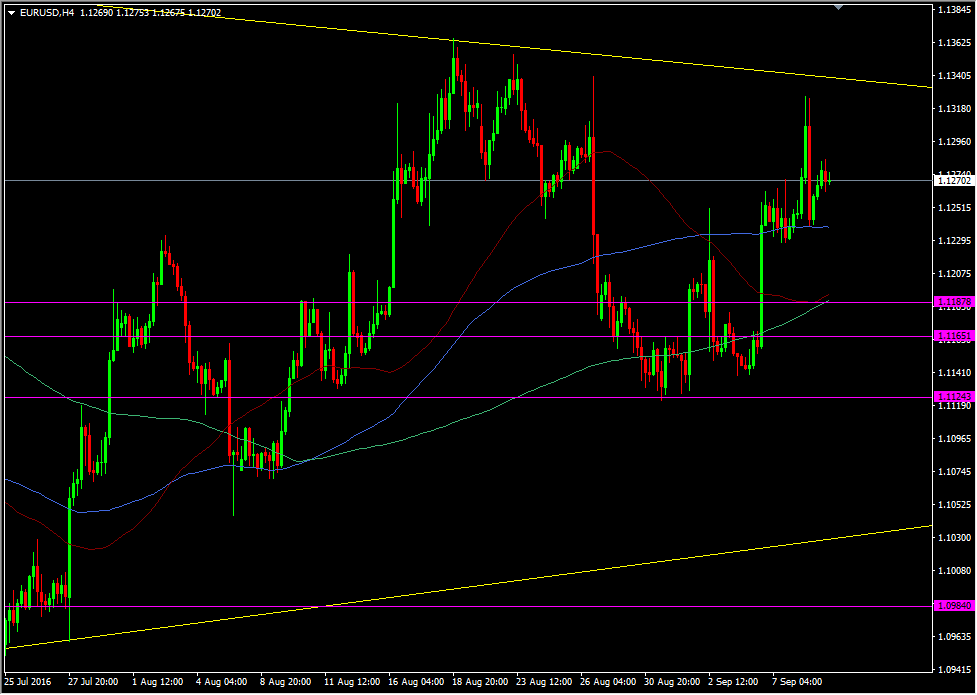

Under that we have old S&R at 1.1185/90. It's use has been waning more recently but it's now got the backing of both the 55 & 200 H4mas

EURUSD H4 chart

Even further down and back on the daily chart, there's another confluence of the 55 and 200 mas around 1.1136/43. In between there's yet another old S&R level at 1.1165.

I must admit I do like a confluence of levels when I trade. The more tech packed into a smaller range the stronger I believe the levels are. The more bricks you have to build a wall, the stronger you can make it. There's enough here to give some interesting entry points and to define some pretty low risk, and that is what we should be looking for when trading.

As expected, the euro didn't break out anywhere yesterday so slow and steady trading off the defined levels is the way to play it right now.