ANZ's latest commodity price outlook piece, out today

ANZ's main points:

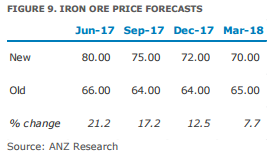

- In the short term, we don't expect the recent weakness in iron ore prices to develop into a full blown sell-off. A combination of further supply-side reforms in China and relatively stable domestic demand especially from the infrastructure sectors should continue to support steel demand. As a result, we have upgraded our average annual iron ore price forecasts by 17% to USD79/t in 2017. In particular, we expect prices to hold around USD80/t in Q2 2017.

- Fresh curbs on Chinese property purchases represent the main risk to prices. China has rolled out a fresh round of property purchase restrictions recently across more than 20 cities and/or counties. However, our China economists believe these measures will only temporarily cool a red hot property market. In fact, pent-up demand could be unleashed once existing policies are loosened.

- Some of the weakness in iron ore prices has also been attributed to concerns over inventories of steel and iron ore. However, we believe these concerns are overdone. Crude steel inventories are actually at their lowest levels for this time of the year since data was first collected in 2010. For iron ore, while absolute stocks are high, in terms of days of consumption, they are only just above the range we have seen over the past ten years.

--

For today, Dalian iron ore is a little lower, down 1.3%