From Credit Agricole:

While it will be an 'uncertain Summer' post the Brexit vote, we think that the likelihood that little will get done, in terms of negotiations of the UK's exit from the EU, until October means that volatility could quieten down and commodity currencies experience some near-term upside on the back of carry trade demand.

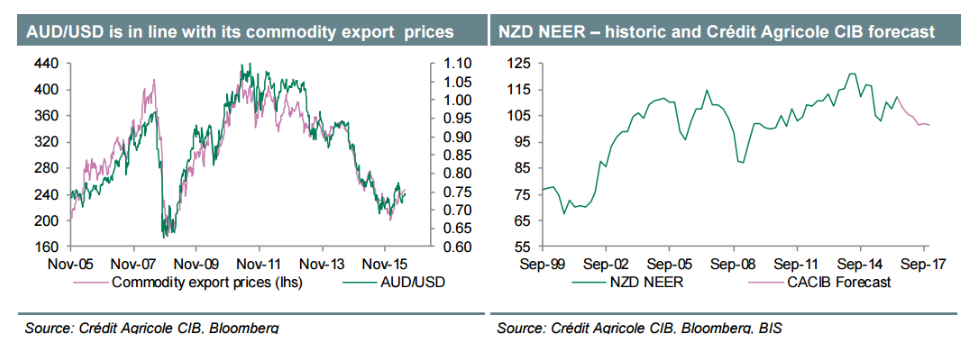

However, we see that the AUD is currently close to its long-term fundamental value and that a rally without the justification of improved outlooks for global growth, commodity prices or the Australian economy would push it into overvalued territory.

This overvaluation would be corrected in the medium-term by any of:

1. The RBA being forced to cut rates significantly, by further than what we expect, ie, two to three more rate cuts rather than just one; 2.A fresh round of risk-off trading on the back of fresh Brexit news; 3. A return to negative sentiment toward China's growth outlook;and/or 4. The FOMC continuing with its rate normalisation cycle, albeit at a slower pace. Importantly, these events are not mutually exclusive, in our view.

Crédit Agricole CIB's forecast is for Chinese growth to continue at 6-7%, which would be a benign outcome for Australia's export commodity prices. So we think that the other three sources of a downward correction in the AUD are more likely, Among these three a return to FOMC rate normalisation is the more probable source of AUD weakness in the medium term, in our view. The Antipodeans' exposure to Brexit fallout is indirect via its impact on Chinese growth, given China's strong trade and investment links with the EU. And reduced demand by SWFs for GBP as a reserve currency could lead to more reserve allocations toward AUD and CAD; not so much the illiquid NZD.

We think that Summer-time rallies in the AUD/USD back above 0.7600 should be sold into. The exception to this would be if the incumbent Liberal/National Party Coalition were successful in gaining a majority in both the House of Representatives and Senate in the general election on 2 July. In that case, we would set our sell levels higher and on the way to 0.78.

For bank trade idea, check out eFX Plus.