What it means if the Fed hikes in September rather than December.

The most-interesting Fed headline yesterday wasn't even from a Fed President, but rather the head of research at the Atlanta Fed, David Altig. It's rare to see public comments from non-Presidents and suggests he might be in-line to take over from Lockhart.

In any case, he said a late-Summer liftoff is still most probably and a Summer hike is "not out of the question." It probably is out of the question but late-Summer (or September) is still in play.

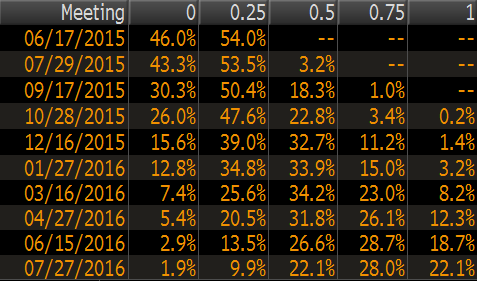

The market sees just a 16% chance of a Sept hike and liftoff isn't fully priced in until Dec-March (depending on how you see the Fed moving up the range).

Some interesting research from Alan Ruskin at Deutsche Bank shows that bringing the Fed rate hike forward from being fully priced for January 2016 to fully priced for September 2015 would normally help the US dollar by at least 4% against the euro and pound.

If you have any doubt about the importance of central banks, also consider this from Rushkin:

"FX macro players are obsessed with the timing of the first Fed rate hike, as they should be! In the last two years, the difference in expectations on the timing of the first Fed and BOE rate hikes, explains a stunning 86% of the variation in GBP/USD.

Over the last 2 years the timing Fed's first rate hike explains half the variation in EUR/USD level, and the Fed and ECB timing combined explains 60% of the variation in EUR/USD."