The Fed want to see "some" more improvement in the jobs market before raising rates. What does that mean?

The comment on jobs is still the one that stands out for me

Taking a look at the numbers let's see what we think will be enough for the fed to raise rates

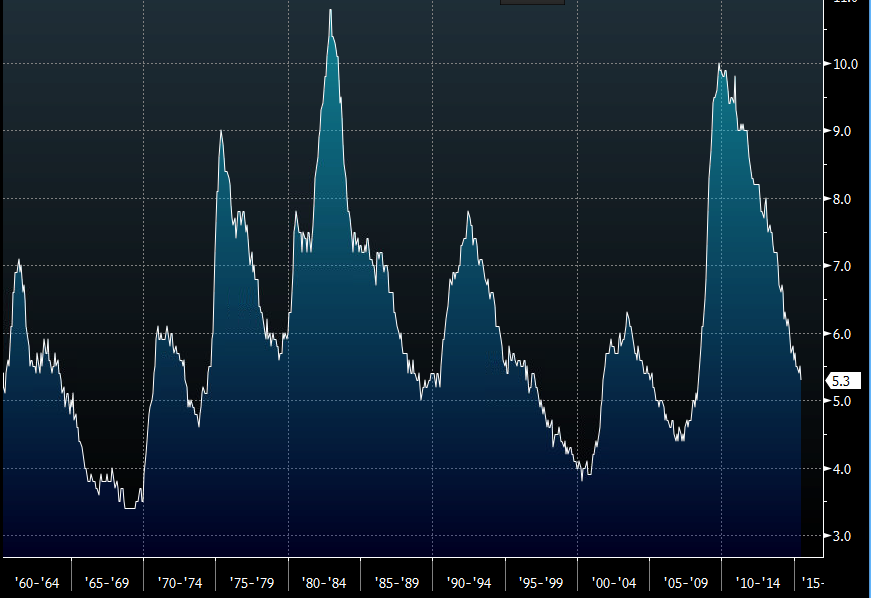

Unemployment has only been below 5% four times in the last 50 years and even then hasn't stayed below for longer than 5 years

US unemployment

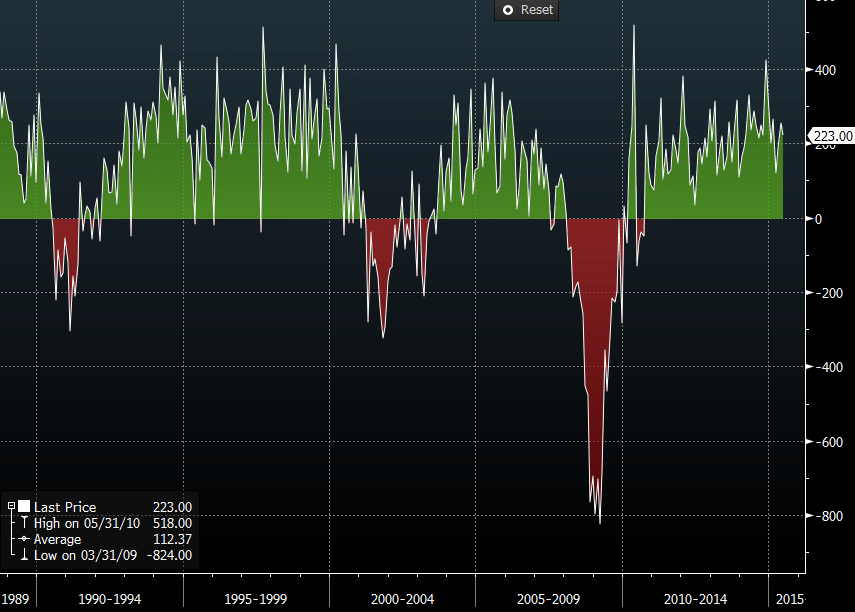

Non-farm payrolls are on their longest positive run ever

US NFP's

On that front the jobs market has never looked so good

Here's one reason why the Fed is being cautious

Average earnings y/y

Wages are still lagging behind but the consumption numbers show that the US folks are spending more which means they are feeling more comfortable about their finances, of course they could be all be borrowing but it still goes into the economy

What more does the jobs market need to do in the eyes of the Fed?

Underemployment could improve meaning that more skilled workers can get into better and higher paid jobs. The participation rate is also an issue, as more enter the labour market it potentially keeps unemployment elevated, if there are no jobs for those joining the queues

At the end of the day you can massage and spin the numbers however you want to paint a good or bad picture but as traders this is one of those moments about making things simple

Payrolls remaining 200k+ and unemployment down to 5% between now and September will put that meeting firmly on the map. If they want more from jobs than that then they are making excuses for not raising