USDJPY posts the biggest drop since the 2011 rally

There's been quite a few calls recently that the BOJ are unlikely to intervene to halt the strengthening yen. They may be partly right, if we're talking about right now. However, looking at the wider picture there's reasons why intervention might not be that far away.

Looking at the chart over the big rally from 2011 we can see that dips from new highs have been round about the size you would expect from a trend like that, until we get to the current "dip".

USDJPY monthly chart

Just since Feb we've seen the biggest drop since the rally began. It's even bigger if we take it back to the 2015 high but there was a period of consolidation after that high, not the swift drop we're seeing now.

The BOJ like most central banks aren't into short-termism. They won't intervene unless the currency really hits an air pocket. That doesn't mean that they won't intervene via monetary policy rather than direct fx intervention. It all has to be looked at in the wider picture than whether USDJPY is going to bust 108 right now.

We can probably say that Japan has been spoilt with the level USDJPY reached during this rally. It probably went beyond where they expected. When we broke 100 everyone was happy with it staying in a 100-115 range. Well, they got a bit more out of it. Psychologically the 100 level is huge. I said 110 was too, as a break would have people switching to thinking about going to 100. Don't underestimate the power of that sentiment in keeping this bearish pressure on. 100 is also the level I'd pick for an intervention point, but that depends on if, and how the price volatility acts over the coming hours, day's or weeks.

But, remember, intervention is a big short term event. Very rarely does it have any real lasting effects, so don't go thinking we'll be going to 120 if they intervene near 100. Prior interventions were worth between 300/400 pips initially. The bigger risk will come from any changes to monetary policy as that's where they can enact longer lasting and more far reaching tools than jumping straight into FX.

And let's not forget the other side of the coin. The US won't be complaining about this drop in USD, and will do nothing to stop it either. Maybe this is all Yellen's grand idea ;-)

So what's the plan?

As I've mentioned just now, a quick break of 108 could get the phones ringing, especially if it blows through to the low 107's but the risk of actual intervention is low. For the bigger picture the 100 level is the big one but there's plenty in the way of that.

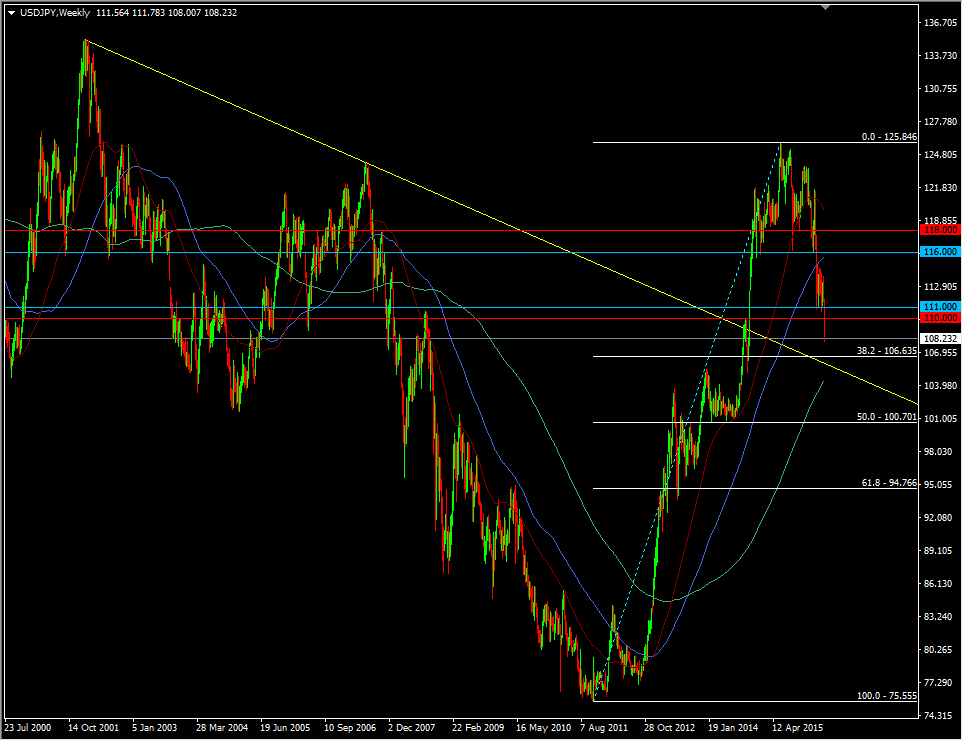

USDJPY weekly chart

One thing I do know is that this pair is often very good with longer term fib levels. Jump on a monthly chart and draw 3 in from the 1998, 2002 & 2007 highs to the 75 lows and you'll see what I mean.

This one above from the 2011 swing could play a big part in trading going forward. That's at 106.63. We also have a broken trendline from that 2002 high sitting at 106. Just under that is the 200 MMA at 105.77. From a technical perspective these are the sort of big long term trading levels I love, and here we have three sizeable ones quite close together. If they work like other similar levels in this pair have done, they could be worth in excess of 200 pips but as always, we have to judge that trade at the time, so I won't be blindly trading them just because they are there.

To summarise

- The risk of intervention will increase with volatility

- If not though volatility, the risk will increase the closer we move to 100

- A move to 100 (or it looking like it will go to 100) will raise the risk of additional monetary policy action from the BOJ, rather than intervention

- If 100 breaks they might think about throwing the kitchen sink at it

What price they may intervene at is pure guess work. The best we can do is look for the conditions that may bring action. At the very least that gives us a chance to be ready and to make sure we are in control of our trades by narrowing down our risks in those conditions. In the end, that's all we can do to protect ourselves.

As a reminder, here's my guide to intervention from Feb.