The Ira Sohn conference is a platform where hedge fund managers often reveal new ideas

The New York Ira Sohn conference is on today and features some of the biggest names in hedge funds. Every year, a few of them reveal stock market picks that were previously undisclosed. It's also a look at some global macro themes.

Among the highlights are:

- Jeff Gundlach

- Bill Ackman

- David Einhorn

- Larry Robbins

- Keith Meister

Former Fed Governor Kevin Warsh is also on the agenda. He ripped into the Federal Reserve on Friday in front of an audience that included FOMC members.

Here's what we know about the schedule (all times ET):

- 12:25 pm - Keith Meister

- 1:25 pm - Bill Ackman

- 3:30 pm - David Einhorn

Last year David Einhorn said:

- The recovery in commodities will be much less than market thinks

- Market thinks CAT is at a trough, but he is bearish ... thinks it bottoms in 2018 at $2 or less earnings per share and shares will be halved

Stanley Druckenmiller said:

- Buy gold

- Sell stocks

- He lambasted the Fed.

Jim Chanos said he was short:

- Tesla

- Valeant

- Alibaba

Larry Robbins recommended:

- VCA Inc.

- Thermo Fisher Scientific Inc.

- AbbVie Inc.

- Anthem Inc

Adam Fisher:

- Short Japanese long bonds

- Long European bonds

Zach Schreiber

- Short Saudi riyal vs US dollar (it hasn't moved)

- Doesn't think oil will rebound above $55

Gundlach:

- Utilities are overvalued

- Go long REITs

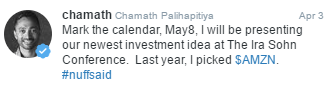

Palihapitiya

- Buy Amazon, it could be worth $3 trillion (great call, it's up 40% since)

- He also likes Bitcoin

He's hinted that he likes Google, Netflix and Workday. The first two are probably too big for him to move the needle but a pitch for Workday might be worth a punt.

Here is the scorecard and recap of 2015 presentations, where Zach Schreiber made what was probably the best presentation in the history of the conference.