Goldman Sachs highlight levels for the oil price, the topside is getting close

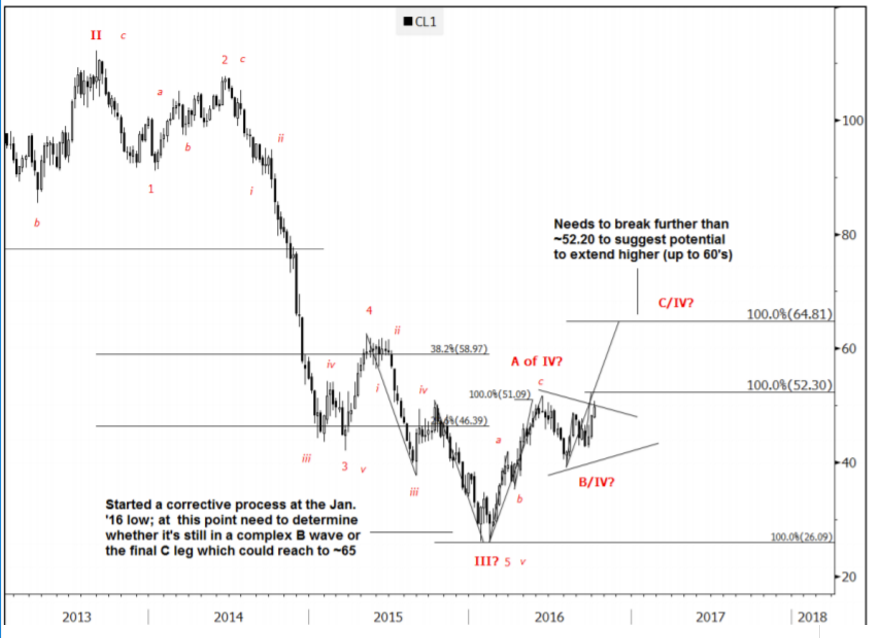

The Oil market has been in a corrective process since the January low.

It's since seen the A and B legs of an incomplete ABC. As is often discussed, it's common for B waves to be more contracted/complex. As such, the market needs to break meaningfully past 52.30 to suggest potential to have started its final C wave advance.

This 52.30 level is derived from an ABC off the July low. The implied target for wave C (from current levels) is somewhere near 60/64.

Until this break above 52.30 is attained it seems sensible to treat this as a range trade; i.e. highs in the ~50/52 region and lows down at 43/42.