Goldman Sachs on the Bank of Japan decision and what it means for the yen

Ahead of the July meeting, markets were expecting the BoJ to take aggressive action to reverse the rebound in the Yen since January. But in the event, the BoJ only raised the size of ETF purchases from JPY 3.3 tn to JPY 6.0 tn per annum, something seen as incremental by markets when compared to JGB purchases of JPY 80 tn annually. Perhaps in an effort to head off adverse market fallout, Governor Kuroda announced a "comprehensive review" for today's meeting, with the aim of reviewing the effects of QQE since its introduction. In the event, the "comprehensive review" brought fundamental changes.

The BoJ is moving away from quantity targets and switching to yield curve targeting, specifically committing to keeping the 10-year JGB yield around current levels (our rates team's forecast for year-end 2016 is 5bp, and we are not changing this). We see this shift as an elegant way to end the market debate over JGB scarcity, which we have on various occasions argued never made much sense to begin with.

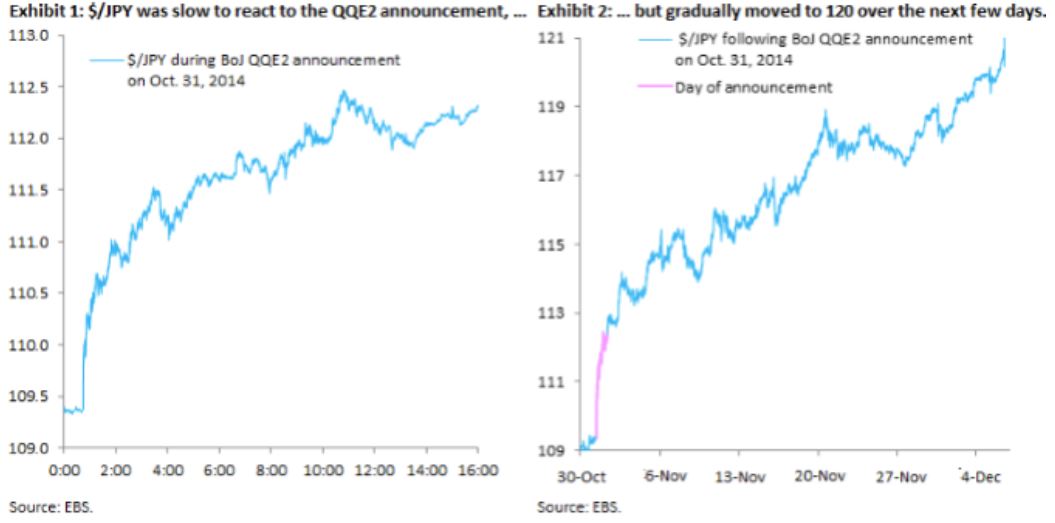

In a separate change, the BoJ is committing itself to achieve an inflation overshoot, i.e. pursuing a policy of negative real rates through bond purchases until inflation is above the two percent target. While the switch to yield curve targeting is arguably neutral, given that it aims to keep the 10-year yield around current levels, the commitment to aim for an inflation overshoot is a meaningful dovish change. Much as in Oct. 2014 when QQE was upsized, price action has been lagging. But we expect $/JPY to move higher on these steps and move to 108 by year-end, our 3-month forecast for this cross.