There's no flies on Goldies when it comes to seeing a pattern. Here they take a long hard look at the weather

"Growth decelerated sharply in Q1 in 2014 and 2015, and we suspect

that unusually harsh winter weather contributed. With the winter

season now upon us, we revisit old lessons learned and develop new

rules of thumb for estimating the economic impact of weather fluctuations"

They've put together a rule of thumb indicator to try and calculate the possible outcome from any bad weather on the US economy

The first is the deviation of heating degree days (HDD). This measures cold temperatures from seasonal norms

The second is the Regional Snowfall Index. This scores hundreds of major snow storms and their societal impact

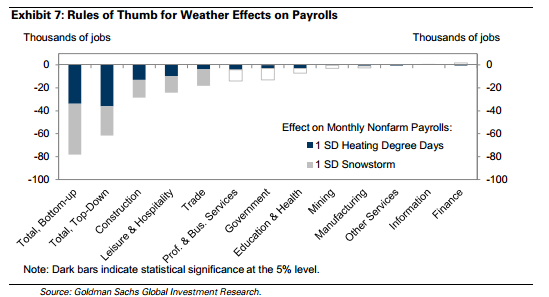

Their conclusions from these indicators are;

- Temperatures and snowfall matter for growth. 1 standard deviation (SD) in the HDD accounts for a 0.4 percentage point loss in GDP growth. A 1SD snow storm is associated with a 0.3 PP loss to growth

- Weather patterns have a "tell" by way of an uneven pattern of impact over the economy " Comparing the effect of weather variables across top-tier indicators, across sectors in the Gross State Product data, and across industries in the payrolls report, we find

that weather typically has the largest impact on construction, retail

trade, leisure and hospitality, foreign trade, and manufacturing - Payrolls are affected by around -35k each for every estimated 1SD colder month and 1SD of snowfall when measured during the reference week, and when using the intra-month weather pattern against state level data

"Slightly more favorable temperatures in the weeks leading into the November reference

period should make a small positive contribution to payrolls this month. The employment

components of business surveys have been mixed so far, and the labor differential

included in the consumer confidence report declined. We therefore expect a gain of 200k

in November, a bit softer than the 215k average gain over the last six months."

The main reason that they are looking at the weather in greater detail is that data is already seasonally adjusted but it doesn't account for weather that differs significantly from the seasonal norms. It's a fair point but whether it takes such complex calculations to work out that the weather is particularly crap at any one point, and thus could affect growth, is there to be discussed. Either way we've had two years on the spin where the weather has played a role in explaining, and being used as an excuse, a slump in the data

Let's see if Goldies nail any changes with their research

But Goldman's have us covered