Forex news for US trading on Oct 22, 2015:

- ECB's Draghi - Degree of accommodation will need to be re-examined at Dec meeting

- Canada Aug retail sales ex-autos 0.0% vs +0.2% expected

- ECB leave rates unchanged at governing council meeting

- ECB's Draghi says there are still concerns over emerging markets

- Initial jobless claims 259K vs 265K expected

- US sells 30-year TIPS at 1.200%, what it means

- ECB's Noyer: recovery in underlying inflation shows QE working

- October 2015 US KC Fed manufacturing index 4 vs 1 prior

- Oct Eurozone consumer confidence -7.7 vs -7.4 expected

- September 2015 US existing home sales 5.55m vs 5.38m exp m/m

- All instruments were discussed at today's meeting says Draghi

- ECB stands ready to adjust design of QE to what's needed

- US Treasury postpones bond auction due to debt limit fight

- S&P 500 up 32 points to 2051

- Gold down $1 to $1165

- WTI crude up 31-cents to $45.51

- Italy 10-year yields down 15 bps to 1.45%

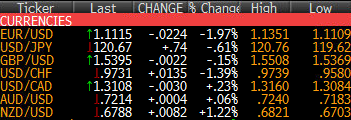

- NZD leads, EUR lags

Draghi talked about increasing QE, cutting deposit rates further and put it all on the table for the December meeting. The result was dramatic as EUR/USD immediately fell about 80 pips to 1.1240 and the continued to grind lower throughout the day, falling as low as 1.1109, below the 200-dma but a shade above the Sept low of 1.1105. Those are the two short term levels to watch.

When the euro was at 1.1188 I wrote:

"There is little on the chart to prevent further selling down to the Oct low of 1.1134 or the late-Sept lows just above 1.1100. I think that's where we're headed (and lower)."

The euro selling spilled over into cable selling. Earlier in the day the pound was flying high after a strong retail sales report but it all unwound as GBP/USD fell to 1.5368 from 1.5508. It's a bit overdone but that's the way it goes when the euro is in the fetal position.

The US dollar also got a lift from a very good initial jobless claims report (for the second week in a row). That was part of the reason USD/JPY climbed to 120.68 from 119.77. The larger part of the reason was good risk appetite as yet another central bank heads to the printing press.

The commodity block was an afterthought today except on the crosses. USD/CAD rose on the soft Canadian retail sales report and hit 1.3168 but it slid back below 1.3100 on upbeat sentiment.

AUD/USD hit an airpocket at the start of European trading, there was talk of AUD/JPY selling after CBA decided to join Westpac with a rate cut. That 50 pip fall stopped at 0.7177 and was eventually retraced. A second decline bottomed after initial jobless claims at 0.7182 and we finish at 0.7212.