Forex news for North American trading on December 9, 2016

- Fitch affirms UK at AA; Outlook negative

- Surprise. Surprise. Stocks close at record highs

- CFTC commitment of traders: JPY turns to short side finally.

- WTI crude oil futures settle at $51.50 per barrel

- The Atlanta Fed GDPNow estimate for 4Q remains unchanged at 2.6%

- Baker Hughes rig count total 624 vs 597 in the current week

- Italy is essentially ready to step in with emergency decree on banks if necessary

- Mexico seen contributing to non-OPEC oil output cuts- Sources

- Gold tests 10 month lows as sellers remain in control.

- A grand week for European stocks even after the punch bowl empties

- US 30 year bond trades at new high yields for the day

- Reduction in QE pace shows confidence in the Eurozone economy says Coeure

- Goldman's Gary Cohn offer National Economic Council Director

- ECB Coeure: Support for EU will weaken without growth/jobs

- How do you cope with the psychology of trading?

- The expectation bar has been raised for Trump's performance says Michigan's Curtin

- US Wholesale inventories for October (final) -0.4% vs -0.4% est.

- December 2016 Michigan consumer sentiment flash 98.0 vs 94.5 exp

- We might have had a 12 month ECB QE extension according to Reuters

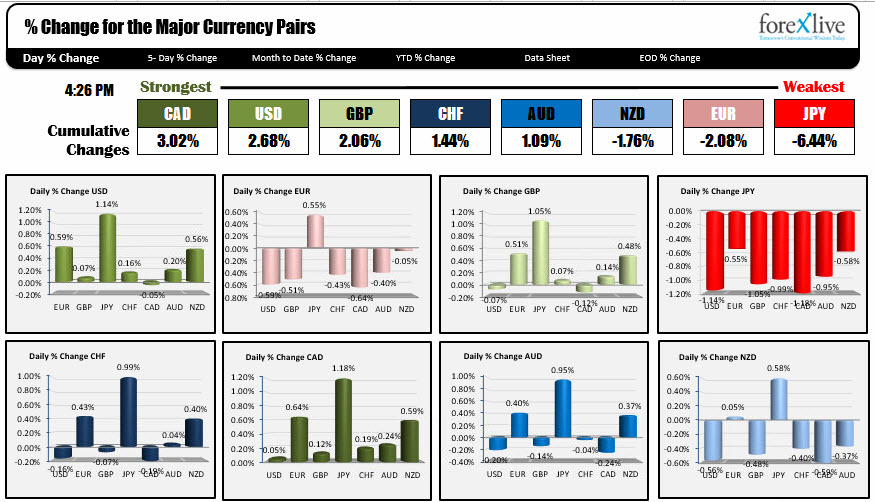

- The strongest and weakest currencies as NA traders enter for the day

In other markets:

- S&P index +13.34 points or 0.59%

- NASDAQ composite index +27.14 points or 0.5%

- Dow industrial average up 142.04 points or 0.72%

- two year notes 1.134%, +2.4 basis points

- 5 -year notes 1.8857%, +4.8 basis points

- 10 year note 2.4656%, +5.8 basis points

- 30 year bond 3.1537%, +4.8 basis points

- Spot gold $1159 $-11.50 or -0.98%

- Crude oil futures of $51.42 plus $.58 or 1.14%

- The CAD was the strongest of the major currencies rising ag. all the majors The Non-OPEC members will be meeting this weekend to discuss output cuts. The JPY was the weakest.

The news was fairly limited today but the University of Michigan consumer sentiment was much stronger than expectations and 98.0 versus 94.5. Current conditions increased to 112.1 versus 108.5 estimate. Expectations increased to 88.9 versus 87.0 estimate. The increase goosed the dollar higher - sending the EURUSD to new session and week lows and the USDJPY ultimately to new week highs. It also helped to turn bond yields back higher. AN exception was the USDCAD which was influenced by position squaring ahead of the non-OPEC meeting in Vienna. Russia is expected to cut production by 300 bpd, Mexico was rumored to be mulling a 150K bpd cut.

Stocks continued the rally. Traders are scrambling. Gold bugs are feeling the heat as it traded near 10 month lows. Bond yields rebounded higher with the 10 year heading back to the double top at the 2.49% level. The 30 year moved closer to the 3.25% target.

EURUSD:

The EURUSD fell below the 1.0551 level (low from last weeks trading) after the much better than expected University of Michigan sentiment index. That move added to an already bearish momentum move lower, that gathered momentum on the break of the 1.0600 level earlier in the day. The triple bottom (April 2015 and December 2015, and November 2016) lows at 1.0517-21 was approached at the session lows on Friday, but could only get to 1.0530 before stalling. We are ending the week at 1.0558 area - just above 1.0551 and above the 1.0517-21 key support level below PS the low for the year reached 1.0503 on Monday after the Italian referendum but quickly rebounded. Those areas are the levels that need to go below for the next leg lower.

The catalyst this week activity?... Draghi and the ECB. On Thursday, the ECB extended QE and earmarked a taper in April (from 80B to 60B) but it came with all sorts of caveats. The additional selling this week keeps the sellers in control. The Fed next week will be eyed as a key catalyst for this pair. Does the Fed hike and raise expectations into 2017, or do they hike and keep a cautiously optimistic stance. We will see, but the sellers remain in control with the 1.0600 level as a close resistance level to get above in early week trading to take some of the bearish pressure off.

GBPUSD:

I did not say a lot about the GBPUSD on Friday. The low for the day was at 1.25516. The low yesterday came in at 1.25476. That was the low for the week as well.

The 200 hour MA was broken yesterday and the price moved back above it in trading on Friday. That move back above the MA failed.

So we head into the weekend with a little more of a bearish bias. The 200 hour MA is at 1.2612 and is close risk for intermediate shorts now.

The next downside targets on a break of this weeks lows will have the pair targeting the 50% of the move up from the November 18 low. That downside target comes in at 1.25378 level. Below that, and the 1.2500 level will be eyed.

Longer term, this week, the GBPUSD high price stalled just ahead of the 100 day MA (currently at 1.2775 - the high reached 1.2774 on Tuesday). The price has not traded above the 100 day MA since Brexit day. So the successful test this week, keeps the longer term sellers still in control. A move above that MA will be needed to change the longer term traders around.

USDJPY

The upside resistance was broken in trading today and you have to say "The bulls remain in control". You can also say the bears/sellers failed this week.

There was key resistance at the 114.44-54 area (highs from March 2016), 114.68 (100 week MA) and 114.86 (swing high from mid Feb 2016). On Monday, the first two resistance levels were taken out with a push up to 114.77. That break failed almost immediately. The shorts/ sellers had their shot to take the pair lower.

What they did was take the price down to the 200 hour MA at 113.17 (the low reached 113.15) on Monday, and the price bounced. On Thursday, the price moved below the rising 200 hour MA again. This time at 113.46, and the low from Monday at 113.17, but could only get to 113.10. That was not much of a break and run, was it? NOPE.

The selling opportunity was a flop and the price started to step higher yesterday, and continued that rise on Friday.

The move oon Friday, took the price above those three resistance levels - including the 100 week MA at 114.68 - and we ended the trading week near the highs for the day, the week, and since Feb 2016. The next targets comes in at 115.60 (61.8% of the move down from the 2015 high), 115.95 (swing low from January 20, 2016). Above that and we could be looking toward a topside trend line resistance level on the daily chart at 117.50.

Risk for longs remain at the 100 week MA at levels from 114.44 to 114.86. They were resistance this week. They are now support in the new week.

Fundamentally, the stronger US economy and higher yields are helping the USDJPY's trend higher. The 10 year note's yield moved to 2.47% today. There is a double top at 2.49%. A move above, and the USDJPY will be following the trend.

USDCAD

The USDCAD has stepped down in trading this week. They had strong housing data on Thursday. Last week, OPEC helped with their production cuts. Employment was not bad a week ago. Poloz is ....meh.

Technically, this week, the price fell 4 days and was unchanged the other day. The price fell below a trend line in trading on Thursday at the 1.3226 level but stalled near the key 100 day MA at 1.31925. ON Friday, the price fell below the 100 day moving average and the 50% retracement of the move up from the mid-August low at 1.31752. The low extended to 1.3151, but rebounded into the Friday close.

The 100 day MA at 1.3192 remains a level to stay below if the bears are to remain in control.

If corrections can stay below that MA line, that is the best case scenario for the bears/sellers. If so, the 200 hour MA at 1.30779 becomes the next target.

NZDUSD

The NZDUSD fell below the 100 hour moving average on Friday at the 0.7153 level and extended to the 200 hour moving average - currently at 0.71278. Traders came in against the 200 hour moving average, and corrected the price higher in the New York afternoon session on Friday. However the rise was limited and the week is ending near that key 200 hour MA. That level will be key into the new week of trading - a break and we should wander lower. If on the other hand the level holds, then the 100 hour MA above will likely be tested and if broken,m we could make another run at the 100 day MA at 0.71966. The test above that MA on Thursday was a failure.

AUDUSD

The AUDUSD closed the week right at the 200 hour MA at 0.7445 level. The 100 hour MA is above at 0.7460. The 100 bar MA on the 4-hour chart is at 0.7428. So we have a battle in a 32 pip trading range. Let the market and price action call the shots on the next move for this pair.

Wishing you all a happy and healthy weekend.

Below are the % changes of the major currencies vs each other.