Forex news for January 8, 2015:

- December 2015 US Non-farm payrolls 292k vs 200k exp

- Canada Dec employment change +22.8K vs +8.0K expected

- US November wholesale trade sales -1.0% vs 0.0% expected

- Canadian Nov building permits -19.6% vs -2.9% exp

- Fed's Lacker: There is a clear upward trend in place for avg hourly earnings

- Feds Lacker: Friday's employment report showed very strong job growth in December

- Fed's Williams: Economic outlook is good, consumer spending solid

- Fed's Williams: We're pretty confident we're on the right track with inflation

- Fed's Williams sees 3-3.5% wage growth as economy picks up

- Atlanta Fed GDPNow model cuts Q4 GDP estimate to +0.8%

- SNB's Jordan: Negative rates important to relieve pressure on Swiss franc

- Baker Hughes rig count 664 vs 698 prior

- CFTC Commitments of Traders: Traders switch sides on yen

- Gold down $5 to $1104

- WTI crude down 34-cents to $32.93

- S&P 500 down 21 points to 1922

- US 10-year yields down 3 bps to 2.11%

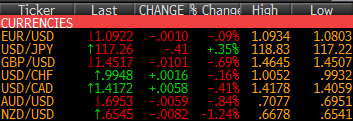

- JPY leads, NZD lags

Non-farm payrolls looked like it would come to the rescue of the stock market and USD/JPY. It was a great report save for the weak wage growth and USD/JPY instantly shot to 118.80 from 118.30 but that turned out the be the high of the day and it was erased in 10 minutes. From there it was a steady stream of selling all the way to 117.32 just before the close. That's narrowly below Thursday's low. It came in low liquidity but it's not a great sign.

The euro trade is a bit of a strange one. It cracked down to 1.0800 from 1.0850 on NFP but turned around like the yen and finished at the highs at 1.0925. It shows that the euro has morphed into a carry funding currency. It might be the first sign that the market is questioning Fed hikes too.

Cable remains in the intensive care unit. Not even broader USD weakness could save it from getting pounded down to 1.4510 from 1.4620 in Europe. It all goes back to those Weale comments in mid-December. Selling that headline was pure gold. Ryan is ready to join the euro.

The commodity currencies are absolutely wretched. Canada posted a pretty good jobs report but oil isn't helping and the weak US dollar was no help for it. The jobs reports caused a few trips around the 1.4100 to 1.4050 range but the buyers showed up into the European close and more at the US close to finish up at 1.4172.

The Aussie and kiwi are another level of weak. Carry trades are getting smashed. The idea is that China will be buying fewer commodities and, boy, has it taken hold. AUD/JPY is now down 7% year-to-date. That's a bad result for a full year and we still have 51 weeks to go.

What a crazy week. I did not see this one coming at all.

Have a great weekend.