Forex news for US trading on Feb 8, 2016:

- NY Fed 12-month consumer inflation expectations fall to 2.42% from 2.54%

- Chesapeake Energy says has no plans to pursue bankruptcy

- Iran tells Russia it will increase it's share on global oil market

- January 2016 US Leading index 0.4 vs 2.5 exp

- Bill Gross: Fed has to stay, lower rates or have new QE

- Lane: BOC doesn't see it as necessary to adopt negative rates

- BOC's Lane: Hiking to curb vulnerabilities in the financial system too costly

- Jan 2015 cap exit was the right strategy says SNB's Jordan

- ECB buys €13,158bn in latest QE count

- Nickel trades at 12-year low as similar-style busts hit virtually every commodity

- Canada Dec building permits +11.3% vs +6.2% expected

- Greece has to convince lenders that the numbers will add up to reach a surplus

- BUBA's Weidmann sees no near-term support for a Eurozone finance ministry

- Gold up $17 to $1191

- WTI crude down 89-cents to $29.98

- US 10-year yields down 10 bps to 1.73%

- S&P 500 down 32 points to 1848

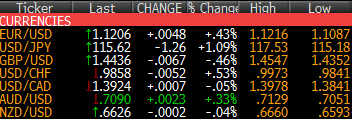

- JPY leads, GBP lags

USD/JPY took out major support near 115.50 as it fell 230 pips from the highs at the start of European trading. It was a non-stop cascade of stops into the London fix, when it hit a session low of 115.18. It bounced to 115.80 from there and consolidated; getting some support late as stocks pared losses. The close is key here.

EUR/USD bottomed at 1.1085 early in US trading. It gradually climbed and then surged at the London fix up to 1.1190. After some consolidation, EUR/USD took out 1.1200 briefly before falling back to 1.1190.

Cable followed a similar pattern as it bottomed early then caught a big bid at the London fix and rallied to 1.4440 from 1.4370.

The energy market was in focus as shares of Chsapeake Energy briefly fell 50% on reports the company had hired restructuring lawyers. It denied plans for bankruptcy but the drop underscored the theme that fears about energy companies are at the forefront.

Oil fell 2.3% but CAD once again held its ground, at least against USD. The pair rose as high as 1.3978 early in US trading and then tested that level again later but failed both times and fell back to 1.3925, roughly unchanged on the day.

AUD/USD managed to finish with a quarter-point gain. It fell to 0.7050 at the height of the worries but recovered to 0.7091. The pair is still a long ways from the 0.7200 level from before Friday's rout.

The S&P 500 broke the late-January low early and that inspired selling. The Nasdaq also cracked the January and August lows, it what looks like a dire technical signal. It's shaping up to be another wild week.