Forex news for US trading on November 4, 2015

- China - PBOC training school prof says rising NPL ratio is not scary

- US stocks move lower at the close. End lower on the day

- OK...the Fed chair said December was "Live". What's so new about that?

- Fed's Dudley: Agrees with Yellen that December is a Live possibility

- Fed's Dudley: US jobless rate tells only part of the labor market story

- US GDP Tracking for the 4th quarter moving higher

- Yellen doesn't see need for negative rates now

- Yellen sees balanced risks to US growth

- ISM helps lift Atlanta Fed's GDPNow to 2.3%

- Yellen says China is flogging Treasuries to prop up its currency

- European stocks mixed at the close

- Yellen's adds 8 percentage points onto Dec rate hike probability

- US incomes are rising says Yellen

- Yellen on the economy: December would be a live meeting, if data supports move

- US DOE crude inventories 2847K vs. 2500K exp

- October 2015 US ISM non manufacturing PMI 59.1 vs 56.5 exp

- OPEC sees downward pressure on oil demand until 2019 - Livesquawk

- October 2015 US Markit services PMI final 54.8 vs 54.5 exp

- Canada international merchandise trade -1.73B vs. -1.75B estimate

- September 2015 US trade balance -40.8bn vs -41.1bn exp

- October 2015 US ADP employment report 182k vs 180k exp

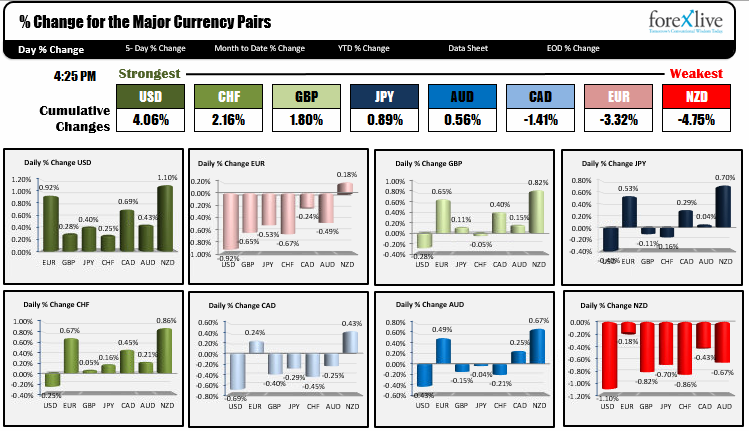

- The strongest and weakest currencies as NY traders enter for the day

- US MBA mortgage market index 414.2 vs 417.4 prior

Janet Yellen was testifying in Washington on banking regulation but was able to get a few comments in on monetary policy and the economy. It is not so much what she said was anything new, it is more that the market believes that she is not necessarily crying wolf. She really means that the Fed may act in December. The proof is that the market increased the probability of a hike. That helped the dollar move higher.

Also helping was a much better Non-manufacturing ISM report (employment and new orders up). ADP also came in at a "new" solid level of 182K.

What about some of our favorite currency pairs?

The EURUSD came into the NY session with a small 54 pip trading range. It is going out with a range of 124 pips. The 70 pip extension was all to the downside. Moreover, the high for the NY session was 1.0932 in the first hour or so. The low extended to 1.0843. So traders enjoyed an 89 pip fall. Not bad. The pair did start to test the swing lows going back to May. The first lows come in at the 1.0847-62 and that was covered. Other lows head down to 1.0807. I am not so sure the market will venture there before seeing the numbers on Friday. Having said that, if the price moves up toward the 1.0900 level in the new trading day, I would expect some selling interest.

The USDJPY tested the 200 day MA on a correction in the Asian Pacific session (at 121.060) and found buyers near the level. In the NY session, the bullish dollar pushed the price toward the 100 day MA at 121.768. The high came in at 121.71 before running out of steam and trading sideways for the rest of the day. The double top from Oct 23 and Oct 30 at the 121.48 has held support on the wander lower. If the price can stay above, the longs would love it. The shorts would feel pressured.

The GBPUSD tried to hold support at the 100 hour MA. That gave way, and the price moved to the 200 hour MA instead at the 1.5356 level. The low for the day came in at 1.5355 suggesting to me, traders loved the idea of buying against the MA level (risk defined and limited). The price rallied modestly higher, but stayed below the 100 hour MA at the 1.5400 level currently. So in the new day, look for buyers at the 200 hour MA, sellers at the 100 hour MA and if there is a break, there could be more buying - or more selling dependent on which way it goes. Although the GBPUSD was lower, it was supported - relatively that is - by a falling EURGBP. The EURGBP fell below a trend line at 0.7070. Stay below in the new trading day and the same dynamic should continue (i.e. GBPUSD better supported).

For the NZD, the NZDUSD continued the fall started with the worse than expected employment report 24 hours ago. The pair did find support buyers below against the 100 day MA at the 0.6582 level. Not far from that was a 50% retracement at 0.6566. Traders stalled the fall between the two and rallied a bit into the close.

USDCAD rallied on the back of higher oil inventories which sent Crude oil lower. The sell off yesterday on higher oil prices, was effectively erased (and then some) today.

In the new day:

- RBA Gov Stevens speaks

- FOMC Fischer speaks at the National economists Club in Washington (at 7:30 PM ET)

- RBA Dep Gov. Lowe speaks at 8 PM

- German Factory orders (est 1.1%)

- ECB Draghi speaks (6:45 AM ET, 1145 GMT)

- BOE interest rate decision (7:00 AM ET/1200 GMT)

- Fed's Dudley, Fischer, Lockhart all speak tomorrow.

- Cad Ivey PMI