Forex news for May 31, 2016

- New Brexit polls shows 'leave' side ahead, GBP falls

- April US PCE core 1.6% y/y vs 1.6% y/y expected

- Canada Q1 GDP annualized +2.4% vs +2.8% exp

- US personal income 0.4% vs. +0.4% est. Spending rises by 1.0% vs. 0.7% est.

- May US consumer confidence 92.6 vs 96.3 expected

- May Chicago PMI 49.3 vs 50.5 expected

- UAE oil minister says he's happy with the oil market

- US restaurant index rises 0.9% in April

- Dallas Fed manufacturing index -20.8 vs -8.0 expected

- French PM Valls says Q1 growth numbers support govt forecasts

- Goldman Sachs sees 35% chance of a hike in June

- US March S&P/Case-Shiller 20-city house price index 5.43% vs 5.11% y/y expected

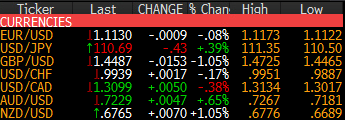

Markets:

- Gold up $10 to $1215

- WTI crude oil down 39-cents to $48.94

- S&P 500 flat at 2098

- US 10-year yields down 1 bps to 1.84%

- NZD leads, GBP lags

The month ended with a few twists and turns. A big batch of data, a Brexit poll and a turnaround in oil were the major developments.

GBP/USD was the big mover on the day. The pair was up in Asia, the skidded lower early in Europe but was trending higher and touched 1.4650 as the US dollar generally softened in early New York trading on soft economic data. Then a poll hit showing the 'leave' side in the lead and it was race to the exits. The pair fell and continued to fall, dropping as low as 1.4465, where the uptrend from the March/April lows finally spurred some bids and a 20 pip bounce.

EUR/USD was higher in early US trading on the heels of better French and German data. USD weakness pushed the pair to a session high of 1.1173 but it was pulled down to 1.1130 on continental worries as GBP crumbled.

USD/JPY was hurt by weakness in stocks and oil along with USD-centric selling on the data. The pair drifted from 111.25 to 110.90 then selling into the London fix took it to 110.70 followed by stock market-related weakness to a session low of 110.50. The final move was a 20-pip bounce as stocks rebounded to finish only slightly lower.

USD/CAD was bounced around. Weak Canadian growth numbers sent it to 1.3075 from 1.3025 but an oil rally snuffed out the move. Crude touched above $50 but then sellers stepped in, partly on speculation that OPEC won't do anything Thursday. That sent USD/CAD as high as 1.3134 before a late slide back to 1.3100.

AUD/USD jumped in Asia on strong exports in the Balance of Payments data. That momentum continued early in Europe and the pair hit 0.7276 . Another push higher early in US trading stalled 0.7261 and then commodity weakness and risk aversion began to weigh in a slide to 0.7225.

Gold broke a 9-session losing streak by bouncing $10. The 100-day moving average at $1218 was the session high. The market is sorting through what to do about the Fed and month-end may have played a role as well.

Here are the FX returns for May.