Forex news for US trading on October 29, 2015

- US stocks end the day down marginally

- Cyprus cuts down on the forex broker bait-and-switch

- US sells 7-year notes at high yield of 1.885%

- Time waits for no man and the dollar is going to get it at month end

- GBPUSD traders pick a new area to play

- Oil stalls at 50% retracement

- ECB stress test to show €14bn shortfall in Greek bank capital

- September 2015 US pending home sales -2.3% vs +1.0% exp

- Stocks set to pullback

- Beware ze inflation!

- October 2015 German HICP flash +0.2% vs 0.0% exp y/y

- Dollar dull as dishwater after GDP

- US dollar dips on GDP data then rebounds

- US initial jobless claims 260K vs. 265K estimate

- Canada RMPI Sept mm +3.0% vs +1.1% exp

- Q3 2015 US GDP advance 1.5% vs 1.6% exp q/q annualised

- Greece says everything is in place for successful bank recaps

- Will US GDP reinforce the Fed's Dec hike wishes?

- ECB's Liikanen sees downside risks for Eurozone

- What's your trade for the new Chinese baby boom?

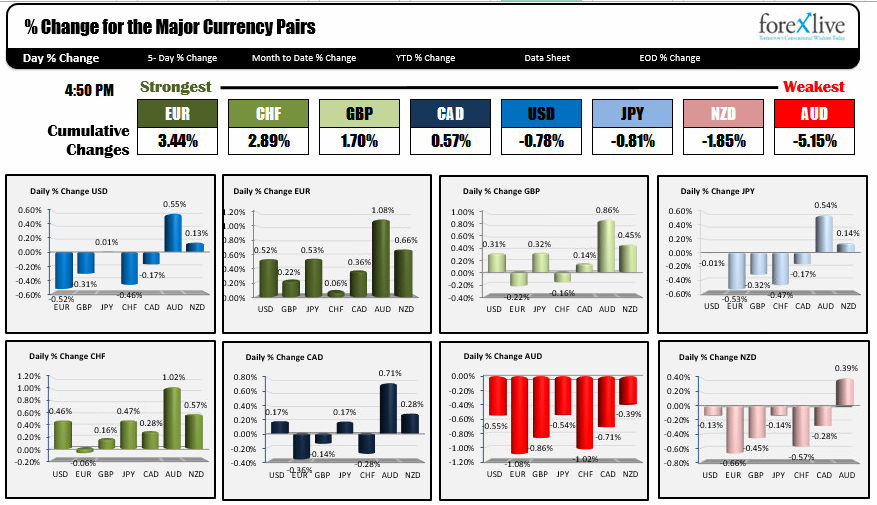

A day after the wild party on the back of the FOMC decision, the dollar had a hangover. Most of the major currency pair outperformed the greenback led by the EURUSD (the dollar was down -0.52% vs. the EUR). The dollar was only able to gain against the AUD and the NZD (marginally). It was unchanged against the JPY as traders await the BOJ decision. For a look at the key technical levels for the USDJPY CLICK HERE.

Fundamentally, US GDP for 3Q was released (this is the 1st cut) and it estimated 1.5% growth - down from 3.9% in the 2nd quarter. Personal consumption rose by 3.2% vs. 3.3%. The Core PCE came in at 1.3%. Inventories subtracted 1.5% from the number (but it added to the prior quarter). In other economic news out of the US Initial jobless claims rose by 1K to 260K. This is near the lowest levels in four decades.

What did the major currencies pairs do?

The EURUSD could not take out the lows from yesterdays plunge at the 1.0895 (the low reached 1.0901) and the day was spent inching higher. In the NY session, a low was reached after the GDP, but prior London morning lows could not be broken and a slow grind continued into the close. In the new trading day, the 50% of the move down yesterday will be eyed at 1.0995 along with the 100 hour MA at 1.1015 (currently and coming down). Look for sellers to try and keep a lid on the pair against these levels.

The GBPUSD rallied higher despite weaker than expected CBI reported sales 19 vs 35 est (49 last). Like the EURUSD, the GBPUSD closed near highs for the day (the high extended to 1.5321 vs close at 1.5309). The low was down at 1.52417. What did not happen today is the pair did not trade at the 200 day MA (at 1.5335). This breaks a 4 day string where the price traded above and below the MA level. Stay below this key MA and the sellers have the edge.

The USDJPY fell in Asian Pacific session, but recovered in the NY session to end the day near unchanged. The "big event" in the new trading day is the BOJ decision along with the semi annual economic outlook report. Last year at this time BOJ Kuroda surprised the market by announcing additional stimulus. This year the consensus is split. There is a chance for a big move in either direction. So adjust positions accordingly.

The USDCHF came off highs going back to March 2015 in trading today. The 100 hour MA is at 0.9851 and will be eyed for bias clues in the new day. Stay above and the bulls remain in control. Move below and a corrective Friday can be expected.

The AUDUSD and NZDUSD trade weaker as traders are expecting the RBA and the RBNZ will more likely ease down the road vs. tighten. If Yellen and the Fed are to tighten, any rallies are likely to be sold in these pairs.

Key events:

Did I mention the BOJ. What time is the BOJ policy announcement today? Eamonn has been so kind to fill us all in HERE.

German Retail Sales are expected to rise by +0.4% vs -0.4%

EU CPI Flash is expected to come in at 0.0% vs -0.1% and Unemployment is expected to remain at 11.0%.

Canada GDP MoM is expected to rise by 0.1% vs -0.4% last month

US Employement cost index is expected to gain 0.6% for the quarter

Personal income and spending are expected to both rise by 0.2%

Chicago PMI is expected to remain below 50.0 at 49.5