Forex news for US trading on Feb 26, 2016:

- US Q4 prelim GDP +1.0% vs +0.4% expected

- US January personal spending +0.5% vs +0.3% expected

- Final Feb U Mich consumer sentiment 91.7 vs 91.0 expected

- US stocks end the day mixed. Bond yields higher.

- CFTC commitment of traders report: Marginal changes in net positions in the current week

- Fed Brainard: There is a role for more comprehensive response to weakness

- ECB Praet: Global growth losing momentum

- Feds Brainard: Weakness abroad may slow the Fed down

- Baker Hughes total rig count 502 vs 514

- UK's Osborne: May need to cut UK spending in budget

- JPY: Why it's wrong to be long - Goldman Sachs

- Atlanta Fed cuts Q1 GDPNow forecast to 2.1% from 2.5%

- European equities climb to finish solid week

- Fed's Fischer: Time-based US forward guidance may be best FOMC forecast

- Fed's Williams: Forward guidance can be 'powerful tool'

- Fed's Powell: Dot plot forecasts help policymakers be systematic

- Fed's Mester: March FOMC should be live

- US Advanced goods trade balance Jan -$62.228 bln vs -$61.2bln exp

- Durable goods orders report put upside bias in Q4 GDP

- Germany CPI Feb flash mm +0.4% vs +0.5% exp

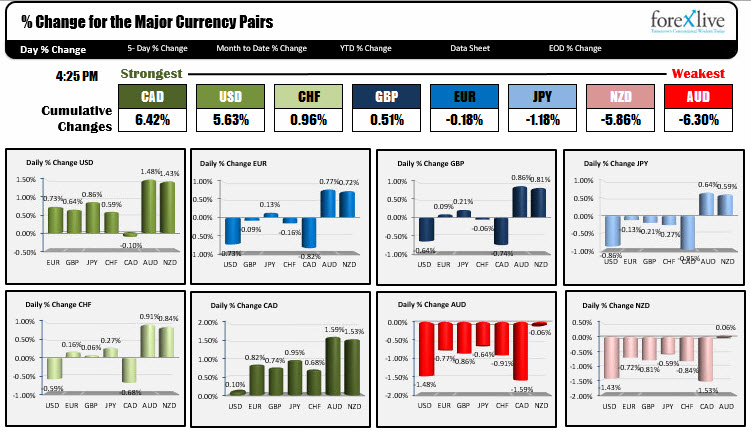

The US GDP took it's cue from the better than the expected Durable goods report earlier in the week and surprised to the upside. It was for the 4Q - so old news - and later the Atlanta Fed 1Q GDP estimate was lowered to 2.1% from 2.5% (it was 2.7% not long ago), but it was the push the US dollar needed to keep the buying going for the day. The dollar was the 2nd strongest currency behind the CAD. The weakest currency for the day was the AUD and the NZD.

The EURUSD fell sharply after the US data (personal spending was also up a greater than expected 0.5%). Fed's Mester also helped the dollar by saying the March FOMC should be live. Technically support against the 100 day MA provided a floor that was good for a 28 pips bounce, but sellers entered, and pushed the price below that key moving average level (at 1.09523). The price continued down to 1.0911 and spent the final 6 hours trading between 1.0911 and 1.0940. For next week, the 100 day MA at 1.0952 area will be eyed for close resistance. Today's close below the 100 day MA is the 1st since February 2nd.

The USDJPY has been marching higher since tumbling to 111.038 on Wednesday and failing to get to the Feb 11 (and year low) at 110.96. Yesterday the price moved above the 100 hour MA. Today, the 200 hour MA and 50% midpoint of the move down from the Feb 16 high were broken (both are at 112.95 currently (now support). The price is closing near the highs for the day - and week- and just shy of the 114.00 level. For the month of February, the pair has tumbled to from a high of 121.47 to the double bottom lows near 111.00. That is about 1150 pips. The 200 pips correction is a small blip. Traders looking for more will want to see 113.45 hold - and if not - the 112.95 level.

The GBPUSD had a rough time of it (that is a bearish time of it) as Brexit fever took hold. A week ago this time, PM Cameron was announcing an EU agreement that took the price up to 1.4358 at the weeks close. The low today reached 1.3852. The close for the week at the 1.3870 is not that far off that low. Today the pair moved briefly above the 100 hour MA (one hourly bar close just above the MA line), but the next bar was back below and the selling intensified again. "It is hard to catch a falling knife" was a phrase repeated a few times this week. Today, that phrase applied once again. The bears remain in control.

In New Zealand, a better trade number got the pair off to a great start in the Asia Pacific session but the bullish reversed, and all the gains from the run up started yesterday, were evaporated. The last 6 hours were spent below the 200 day MA and the 200 hour MA which come in at 0.6646-51 (closing at 0.6625 area). Those levels will be close resistance next week.

AUDUSD also fell sharply after getting close to the 200 day MA (0.7255 high for the day vs 0.7267 for the MA level). The AUDUSD has not traded above the 200 day MA since....anyone, anyone...September 11, 2014! So getting within 12 pips is an accomplishment. The bad news for the bulls is the price decline has the price trading at 0.7124 and back below the 100 day MA at 0.7152. So that will be the closest hurdle IF the buyers want to wrestle back control from the sellers.

Next week highlights include:

- RBA rate decision on Monday night ET/Tuesday locally

- ISM data out of the US and UK on Tuesday. Aust. GDP on Tuesday/Wednesday locallly)

- US ADP on Wednesday

- US ISM non-Manufacturing/Retail sales in Australia on Thursday

- US Non Farm Payroll on Friday with a rebound to 195 expected.

Have a great weekend.