Forex news for US trading on Feb 24, 2016:

- February 2016 US Markit services PMI flash 49.8 vs 53.5 exp

- January 2016 US new home sales 0.494m vs 0.520m exp

- BOE's Cunliffe: Difficult to justify flatness of the yield curve

- Fed's Kaplan: Monetary policy to become more complicated over next couple years

- BOC's Schembri: Our risks are generally much lower than other countries

- BOE's Cunliffe says UK economy to grow slowly

- German bonds ineligible for ECB QE reach a record 45%

- EIA oil inventories 3502k vs 3427k exp

- Chesapeake CFO feels good about the company's ability to pass redetermination season

- The EU isn't in great shape says Germany's Schaeuble

- Strength of recent CPI report was encouraging says Lacker

- Fed's Lacker says inflation expectations are still consistent with 2% target

Markets:

- WTI crude up 40-cents to $32.32

- S&P 500 up 9 points to 1929

- US 10-year yields up 2.2 bps to 1.745%

- Gold $3 to $1229

- CAD leads, GBP lags

Virtually every chart shows a big turnaround in US trading. It came after the weak Markit PMI and a reversal in oil on tighter inventories than suggested by the API report.

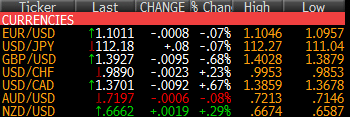

USD/JPY fell more than 100 pips and touched 111.04 at the London fix but it stormed back afterwards and up to 112.10 despite a strong bond auction. Stocks also turned around and safe havens weakened.

The turn came despite soft US data but at the moment, the risk trade is more important than rates. The soft numbers keep the Fed on the sideline. Yield is less important than how stocks will perform and a less-hawkish Fed will keep the money flowing into equities.

EUR/USD rallied early in US trading and up to 1.1040 from 1.0960. Greg highlighted support at the 100-day moving average at 1.0957 and it was quick to rise from there to 1.1040. Later, EUR/USD slipped back to 1.1010.

Cable is a basketcase. it bottomed at 1.3877 as US trader arrived and bounced to 1.3955 before falling back to 1.3900 and finishing at 1.3923. That's another cent lower on the day and another long-term closing low.

The oil inventory data completely turned around USD/CAD and traced out an outside bearish day. The high at 1.3859 was a double top and then it tumbled to 1.3678 as oil reversed from $30.56 to $32.40. There is some big support in the 1.3650/38 zone to watch in the day ahead.

AUD/USD traders are watching out for today's capex report. The Aussie sagged to 0.7144 shortly before the London fix and the turned around to finish flat on the day at 0.7195. Technically, there is an opportunity for a big rally if the data is surprisingly strong.