Forex news for New York trading on March 23, 2017

- House Republican leader confirms healthcare bill doesn't have enough votes

- February 2017 US new home sales 0.592m vs 0.565m exp m/m

- US initial jobless claims 258k vs 240k exp

- Larry Summers says NAFTA needs to be ultra-efficient or China will win

- SNB's Maechler: I'm convinced current policy is correct

- Fed's Kashkari: Everyone on FOMC 'very interested' in balance sheet policy

- Bill Gross calls for universal minimum income in the United States

- US sells 10-year TIPS at +0.466%

- Fed's Kashkari doesn't speak about policy or economy in speech

- Another hedge fund titan bites the dust

- Fed's Williams: Expects 3 or more rate hikes in 2017, depends on data

- February 2017 Eurozone consumer confidence flash -5.0 vs -5.9 exp

- Kansas City Fed manufacturing index +20 vs +14 expected

Markets:

- Gold down $3 to $1245

- WTI crude down 35-cents to $47.69

- S&P 500 down 2.5 points to 2345

- US 10-year yields up 1 bps to 2.41%

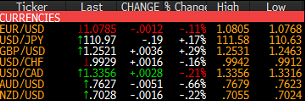

- GBP leads, AUD lags

The story today should be that the pound led once again. Today it was because of strong UK retail sales data but it marks the sixth gain in seven days and that's into a very crowded short position. It finishes the day another 40 pips higher to 1.2520. The late Fed high of 1.2565 is a level to watch.

The story of the day was the ebb and flow of the healthcare debate in the House. It was billed as a Republican referendum on Trump and Ryan but after it was delayed, some selling hit stocks and USD/JPY but it was modest.

As I wrote yesterday "Members of Congress want it fixed in one way or another and that's when a compromise will come. I think markets are underpricing that trade. Win or lose, Trump's administration isn't falling apart."

What all the focus on the vote did was kill volatility. It was a wait-and-see market and we didn't get answers until late in the day.

USD/JPY started near 111.00, dropped down to 110.60, slowly climbed to 111.25, then finished back close to 111.00. All things considered, that's a decent range but moves were slow to materialize.

EUR/USD was a different story as it moved sideways in a 1.0770 to 1.0790 range. It's been narrowing as the day goes on and the House news hardly caused a reaction.

Commodity currencies were generally softer by around 30 pips over the course of trading .Oil was weak once again and that lifted USD/CAD to 1.3355 from 1.3320 in a steady move that's finishing at the highs of the day.

With the House bill delayed until Friday, it looks like we'll have plenty to write about in the day ahead.