Forex news for January 20, 2016:

- Bank of Canada leaves interest rates unchanged at 0.50%

- Full monetary policy statement from the Bank of Canada's January 2016 meeting

- Bank of Canada's Poloz: Likelihood of new fiscal stimulus 'important consideration'

- December 2015 US CPI 0.7% vs 0.8% exp y/y

- Atlanta Fed's GDPNow ticks up to 0.7% for Q4 GDP - Who cares?

- ECB meeting likely to be 'muted' given lack of new projections - report

- OPEC emergency meeting unlikely - report

- The US raised rates because the US economy is recovering says IMF's Zhu

- Canada Nov wholesale trade sales +1.8% vs +0.5% expected

- US Dec housing starts 1149K vs 1200K expected

- December 2015 US CPI 0.7% vs 0.8% exp y/y

- June could be possible for the UK EU referendum - Livesquawk

- Goldman Sachs profits slump with Q4 EPS $1.27 vs $3.57 exp

- Gold up $14 to $1101

- WTI Feb contract expires down $1.91 to $26.55

- WTI March contract down 79-cents to $28.79

- S&P 500 down 22 points to 1859 after falling as low as 1812

- US 10 year yields down 6.6 bps to 1.98%

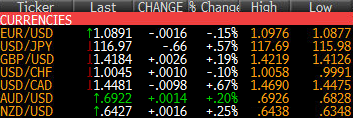

- JPY leads, EUR lags

What a day. It feels like I've written that every day this year.

Stock market bulls have never felt so good about a 22 point drop in the S&P 500. Earlier in the day, the index was down 69 points, had taken out the Bullard low, and were trading at the lowest since April 2014.

In broad FX, the moves weren't as crazy as stocks would suggest aside from USD/CAD. That pair was the focus going in and it was a dramatic day of trading. The pair crumbled almost 200 pips on the BOC decision and then bounced almost all the way back as oil fell and expectations for Poloz to be more dovish in the presser. He wasn't and oil began to turn around. That sent USD/CAD back down to the lows and that's where we finish at 1.4487. The decline today breaks a streak of 13 consecutive gains.

AUD/USD bottomed in Asia at 0.6828 and even as sentiment deteriorated, it held. In hindsight that was a strong sign and AUD/USD made a US afternoon run to 0.6920.

EUR/USD was on the defensive as worries about the European banking system begin to spread. That will be an important subplot in tomorrow's ECB decision. The pair touched the session low late but founds bids ahead of 1.0875.

Yen crosses were stars of the show as they track risk sentiment. USD/JPY breached 116.00 narrowly in Europe but the low in the US was 116.19 and it climbed above 117.00 late as a consolidation pattern broke to the upside.

Cable finished with a rare gain, up 19 pips at 1.4177. It had touched above 1.42 in US trading but then faded to 1.4150. The market hasn't made much of a dent in yesterday's Carney-inspired slump.