Forex news for US trading on November 2, 2015

- US stocks close with strong gains

- Federal Reserve Atlanta GDP tracker for 4th quarter at 1.9%

- US Federal Reserve senior loan officers survey for Q3

- ECB Villeroy says ECB policy produced results

- European stocks end the day higher

- ECB officials met with banks and asset managers before major decisions:FT

- Moody's: Saudi Arabia fiscal position weakening, but still strong

- ISM's Holcomb says data shows employment fell in October

- US construction spending 0.6% vs +0.5% estimate

- October 2015 US ISM manufacturing PMI 50.1 vs 50.0 exp

- Markit US Manufacturing PMI final 54.1 vs. 54.0 prelim

- ECB QE count: ECB sold 88m in ABS vs buying 200m last week

- October 2015 Canadian RBC manufacturing PMI 48.0 vs 48.6 prior

- EU's Dijsselbloem says Greek debt servicing has to be manageable

- UBS happy with EURUSD shorts as their stop remains intact

- Money, money, money: More from guest economist John Hearn

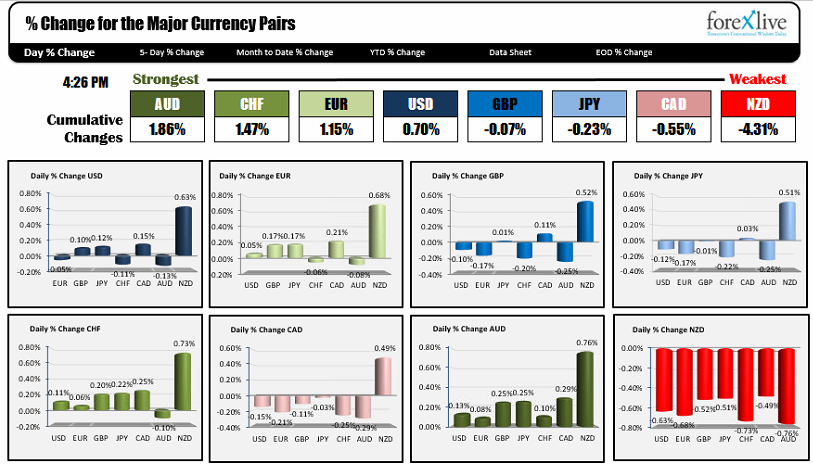

- The strongest and weakest currencies as NY traders enter for the day

The US ISM final Manufacturing data came in at 50.1 vs 50.0. Employment was weaker. New orders were stronger. Six components were below 50.Four components were above 50. Six components were up from the prior month. Four were down from the prior month. The index remained just above the 50 level.

The GBPUSD - which rallied in the London/European morning session on the back of better Manufacturing PMI (55.5 vs 51.3 est) - saw those gains erode and turn negative on the day. The GBP ended the day mixed (down against the USD, EUR, CHF and AUD) after being higher against all the major currencies at the start of the NY session. A rally in the EURGBP (off technical support) helped to turn the tide technically.

The EURUSD rotated lower in a slow methodical way, during the US session and in the process tested the 100 hour MA for the 2nd time of the day (the first test was at the lows during the London morning session). That 100 hour MA comes in at the 1.1002 level. That MA level will be eyed for bullish/bearish in the new trading day.

The RBA will announce their new interest rate decision in the new trading day. The AUD rose against all the major currencies in trading today (it was the strongest). Versus the USD, the AUDUSD is stuck between the 100 (at 0.7120) and 200 hour MA (at 0.7176). The current price at the NY close is around 0.7145. The RBA is expected to keep rates unchanged but the bias is for an ease (if there is a bias). A move below the 0.7120 level should keep the lid on the pair if there is a push lower off an ease. No change, will have traders dealing with the "what next" question. Do they ease? Are they done easing? When? All that will come in the details of the statement.

The USDJPY was up marginally on the day. Technically, the pair rose above both the 100 and 200 hour MAs at 120.67 and 120.63 respectively. The 200 day MA is above at 121.04 and remains a level to get above and stay above if the buyer are to remain in control.

In addition to the RBA rate decision, the other economic highlights include:

- UK Construction PMI Est 58.9

- US Factory Orders Est -0.8%

- US IBD/TIPP Economic optimism est 47.5

- US auto sales

- ECB Draghi speaks at 2 PM He is expected to give opening remarks at the European Cultural Days 2015 event. That does not sound like a platform for a market moving speech.

Upcoming stuff:

- NZD Employment change (Wednesday in NZ)

- AUD Retail Sales and trade balance (Wednesday in Aust).

- Yellen testifies on Wednesday at 10 AM ET

- UK Rate decision on Thursday

- US and Canada employment on Friday

- China trade balance over weekend.