Forex news for US trading on Feb 18, 2016

- February 2016 US Philly Fed business outlook index -2.8 vs -3.0 exp

- Canada December wholesale sales +2.0% vs +0.2% expected

- Initial jobless claims 262K vs 275K expected

- Fed's Williams: We can't pull the rug out from under economy right now

- Feds Williams: Gradual policy normalization the best course

- Kuroda: The 3D money printer

- EUR/USD: Going Bearish Next Week: Range & Outlook - BTMU

- Gold signals that uptrend is intact after break of Tuesday's high

- What is the fall out from central banks going down the negative rate rabbit hole?

- Down with the US

- Saudi's won't cut production - AFP

- EIA US weekly oil inventories +2147k vs +3500k exp

- BOJ's negative rates are starting to bear fruit

- Q4 2015 US MBA mortgage delinquencies 4.77% vs 4.99% prior

- January 2016 US leading index -0.2% vs -0.2% exp m/m

- What trades have UBS got brewing in their cauldron?

- Euro touches fresh low as it clings to support in fifth day of losses

- Weak quarter? Blame the dollar

- UK's Cameron says the right deal is more important than a rushed deal

- ECB minutes: Risks have increased since December

Fundamentally today, US initial jobless claims fell to 262 from 269K last week. The estimate was 275K. The employment trend remains favorable in the US. The Philly fed business Outlook index came in about as expected. Leading indicators in the US were negative, but also as expected. In Canada, wholesale sales surged 2% which was much higher than expected (expected 0.2%).

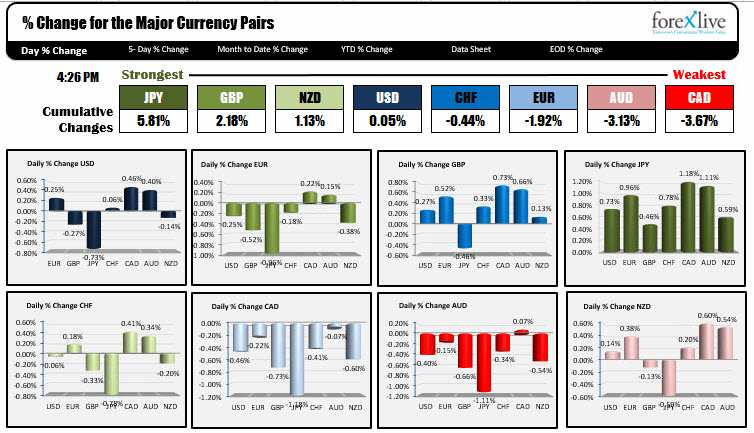

As for the US dollar today, you can characterize the currency as being mixed. It was higher against the EUR, CAD and AUD, but lower against the GBP, JPY and NZD. Against the CHF it was little changed.

For some of the individual pairs, the EURUSD traded to a low of 1.1070. This was close to the low from February 4. That low was the lowest low since the price broke above the 200 day MA (on Feb 3rd). Into the new trading day, should the EURUSD continue to move lower, the 1.1070 and 200 day MA at the 1.10548 will be key levels to eye.

The GBPUSD is ending the day higher vs. yesterday's close, but for most of the New York session, the pair wandered lower after rising in the European morning session. The high for the day - which came just as NY traders were wiping the sleepy stuff out of their eyes - stalled against the 100 hour MA (at 1.4390 at the time -the high peaked at 1.4393). As the final day of the week begins, traders are left with the Thursday low in place (today the low was higher as was the close). However, the 100 hour MA (currently at 1.4378) should provide some resistance.

The USDJPY traded to the lowest level of the week - falling below the lows from Monday at the 1.1327. The low price today reached 113.14. The move lower was helped by the inability of the pair to stay above the 200 hour MA (currently at 113.99) and a move below the 100 hour MA at the 1.13986 level currently. With the 100 and 200 hour MA so close and the price moving away from them in trading today (to the downside), the bears are taking control technically at least.

The better data out of Canada did not benefit the CAD. The USDCAD corrected higher in trading today. The 100 hour MA is at 1.3785 and should provide a ceiling on a test.

The AUDUSD traded above and below the 100 day MA at 0.7148 today, but stayed above the 100 hour MA at 0.7140. Stay above those two levels is more bullish (currently trading at 0.7755). Moving below will likely discourage the bulls and will turn the bias around.

US major stock indices corrected after three healthy days higher. The S&P index fell by -0.47%. The Nasdaq composite was down -1.03% and the Dow fell by -.025%. US bond yields were lower today with the 2 year yield down 5 BP, the 10 year yield down 8 BP and the 30 year yield down 8 BP as well. Crude oil is trading at $30.59 down -0.10%.