Forex news for New York trading on November 17, 2016.

- US stocks end the session higher. S&P up 0.47%. Nasdaq up 0.74%.

- Crude oil futures settle at $45.42 per barrel

- A look around the markets.

- Banco de Mexico raises rates by 50 basis points to 5.25%

- Forex technical analysis. The last time the EURUSD was at these levels...

- Forex technical analysis: NZDUSD tests 200 day MA

- Forex technical analysis: USDCAD breaks above 200 hour MA...

- Fed Brainard: Growth of Gig economy effects how the Fed assess labor mkt outcomes

- SNB Maechler: Able to cut rates further if needed

- No feather ruffling by Yellen leaves European stocks in the green

- Yellen: It's not clear why investment has been as weak as it has been

- Disappointing wage growth is not a new trend says Yellen

- Atlanta Fed's GDPNow raised to 3.6% vs 3.3% prior

- Yellen: Mortgage standards have tightened up

- Yellen Q&A begins..First part of Q&A focused on fiscal and regulatory advise

- Fed's Dudley's a dud

- November 2016 US Philly Fed business index 7.6 vs 7.8 exp

- US housing starts Oct 1.323m vs 1.156m exp

- Weekly US initial claims 235K vs 257K estimate

- October 2016 US CPI 1.6% vs 1.6% exp y/y

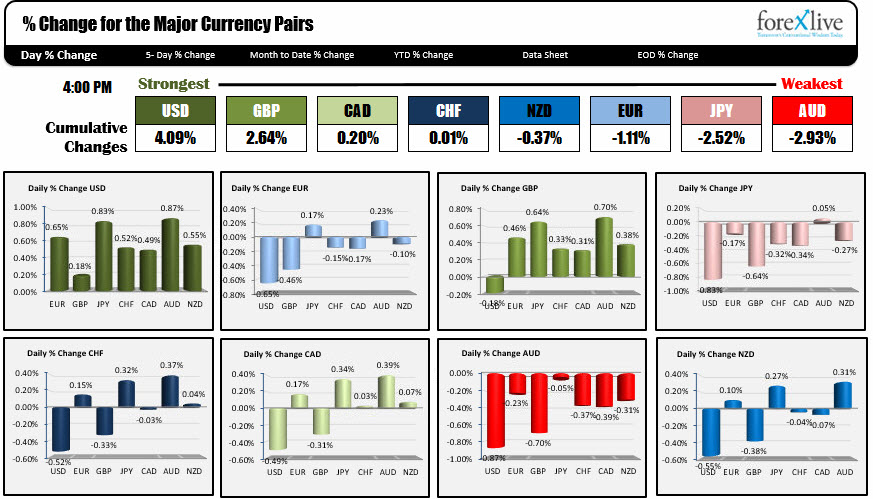

- The strongest and weakest currencies as NA traders enter for the day

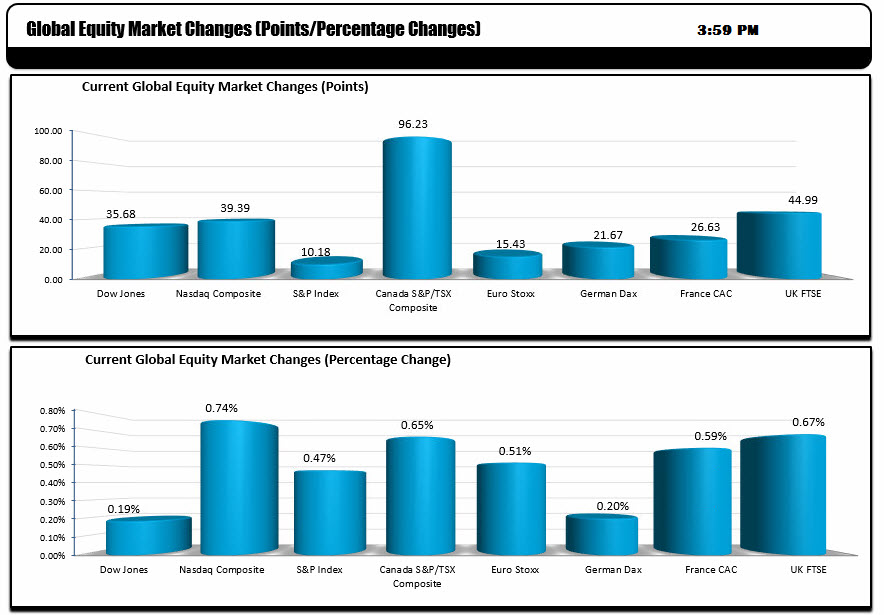

In other markets today:

- S&P index was up 10.18 points or 0.47%. The high extended to 2188.06. The low to 2176.65

- Nasdaq composite index was up 39.39 points or 0.74% . The high extended to 5334.05. The low to 5288.16

- The Dow add 35.68 points or 0.19%

- All the major global stock indices in US and Europe ended the day with gains today.

- Crude oil rating at $45.04 down five cents or 1.21%. The high extended to $46.58 while the low reached $44.96

- Spot gold iis trading at $1214, $-11.22 or -0.92%. The high rreache $1231 while the low extended to $1211

- 10 year note yield equals 2.2866%, +6.4 basis points. The 2-year yield rose by 2.5 basis points to 1.0299%.

The US data today was pretty good

- US initial jobless claims fell to the lowest level in four decades (that is "decades"

- US housing starts increased to 1.323M from 1.1156M. Single family housing starts were the strongest in nine years. This may be the calm before the storm as mortgage rates have soared over 50 basis points since the US election.

- The US CPI data came in largely as expected as did the Philly Fed index.

- The data helped to support a higher Atlanta Fed GDPNow Q4 GDP estimate. That estimate moved up to 3.6% from 3.3% in it's prior report.

Also on the agenda today was Fed Chair Yellen who testified to the joint economic committee in Washington. In her prepared text she said a "rate hike could well become appropriate relatively soon" (as in "December"). She also spoke of the dangers of delaying too long. During the Q&A session, she cautioned about too much fiscal stimulus especially as it relates to debt and an overheating economy. She also gave her opinions on binning Dodd Frank, warning that the banking system is more stable as a result of its capital requirements and other regulations from the bill.

The dollar was the strongest currency in trading today as it showed gains against all the major currency pairs.

The EURUSD rallied in early European trading - reaching within 9 pips of the 100 hour MA. However, the pair started to lose ground as Yellen pre-testimony text was released and the better US data hit the wires. The pair moved below trend line support on the hourly chart and has now extended into a consolidation area from Nov/Dec 2015 (see post here). The EURUSD has now declined for 9 consecutive session. From the high last Wednesday, the pair has moved about 680 pips.

The USDJPY was another currency pair that reached a new move high today. For this pair, the price took out the high from yesterday (above 109.75). IN the process, the USDJPY has moved further away from the 38.2% of the move down from the June 2015 high. That level comes in at 109.268 (now a support level below) and printed 110.00 for the first times since June 1, 2016. Earlier this week, the price moved above the 200 week MA at 108.43. Since the election low at 101.18, the price has move 886 pips.

The USDCAD had used the 200 hour MA as a ceiling until it gave way in US afternoon trading (as 1.3450). The break sent the pair to the 100 hour MA at 1.3490. After holding on the 1st test, that MA was also broken - sending the pair to a high of 1.3525 at the close of the trading day.

The NZDUSD is ending the trading day right at the the 200 day MA at the 0.7021 level. The price has not closed below that MA since March 15th. According to my chart the 200 day MA is at 0.70215. The close was at 0.70216. That is about as close to the MA as you can get. If we do bounce, the pair will have resistance at the 0.7050 level. A move above that level will be needed to get the buyers more excited about a bounce of the MA level.

Below is a snapshot of the % changes vs. the major currencies vs each other.

It is Friday in the new trading day. So to all, have a great new trading day and if not around in the NY session, have an even better weekend with friends and family.