Forex news for US trading on Feb 11, 2016:

- Yellen: Extent of US dollar strength not anticipated by Fed

- Yellen hasn't thought that a rate cut is a possibility

- Yellen: Precipitating factors for markets seem to be Chinese yuan and oil decline

- Fed takes dollar strength into account for policy - Yellen

- OPEC ready to cooperate on cut - UAE energy minister

- US sells 30-year bonds at 2.500% vs 2.467% WI

- Lagarde's reign of terror to continue into second term

- Venezuela proposed oil production freeze - Reuters

- Canadian Dec new housing price index +0.1% vs +0.2% exp

- US initial jobless claims 269k vs 281k exp

- BOE's Cunliffe says current EU bank resolution is not ready to deal with cross border bank failure

Markets:

- Gold up $50 to $1247

- WTI crude down 27-cents to $27.18

- S&P 500 down 23 points to 1829

- US 10-year yields down 3 bps to 1.63%

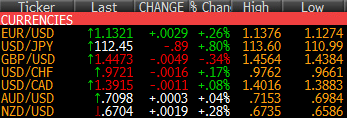

The theme of the day was intervention as inexplicable declines in the yen and Swiss franc hit in European trading. The buying hit just below 111.00 in USD/JPY and we've been sorting through the wreckage since. The first move was up to 113.00 then it ebbed back to 111.54 before a climb to 112.32 to close.

The EUR/CHF trade was much less clear but after a fall below 1.0950 it rebounded to 1.0975 and then jumped to 1.1040. Sellers have been slowly returning in a slide back to 1.1007.

The dual interventions, or at least the illusion of intervention, might promote better two way trading but it's also underscored the uncertainty and FX war. Along with safe have demand it's all a perfect cocktail for gold longs and that's why prices gained $50.

The euro continued its bullish reversal from yesterday but it was a choppy trade. US trading started at 1.1325 and it ranged 40 pips up and down from there before attempting a break higher but offers at 1.1375/80 halted the rally and it was back to 1.1320.

Cable continued to struggle and fell below 1.4400 in Europe. It rebounded to 1.4473 but then made fresh lows in the US down to 1.4384. The bulls finally made a stand there and it's been slowly bid up to 1.4472.

WTI crude fell to a 12-year low at $26.05 late but at nearly the bottom tick an OPEC headline hit saying OPEC was ready to cooperate. There was nothing new there but as soon as 'OPEC' hits the wires at the moment, the bears quickly clear out and we finished back at $27.28.

The CAD and oil correlation is broken at the moment. Despite USD/CAD wouldn't climb when oil was falling then made a sudden run for 1.4400 that was smashed down to 1.3913.

AUD/USD fell hard in Asia down below 0.7000 at the lows but slowly climbed all the way back to 0.7100 and then flattened out. Stevens speaks later.