Forex news for the NY session on January 10, 2017

Intro Paragraph Text Here.

- Nasdaq closes at another record high

- Preview: Trump to hold first press conference since July. What it means for markets

- Crude oil futures settle at $50.82 per barrel

- S&P 500 fades back to unchanged as energy weighs

- Forex technical analysis: USDMXN making new all time highs

- Euro falls to session low in back-and-forth session. What's next

- Atlanta Fed GDPNow unchanged at 2.9% for Q4

- Richmond Fed President Jeffrey Lacker to hang up his boots in October

- Macron tipped to beat both Le Pen and Fillon if they meet in second round elections

- Forex technical analysis: GBPUSD new day highs, goes nowhere.

- Mixed fortunes for Europe's stock markets at the close

- It remains to be seen whether UK can stay in single market after exit

- Eurozone inflation...er I mean oil is dropping at an alarming rate

- Draghi's been hacked

- JOLTS job openings for November 5.522M vs 5.500M estimate

- US November wholesale sales +0.4% vs +0.5% m/m expected

- Here's why forecasters might be waiting a while for parity in EURUSD

- Bill Gross falls in love with technical analysis

- Larry Summers has some bizarre logic on the value of the dollar

- Canada November building permits -0.1% vs -6.0% expected

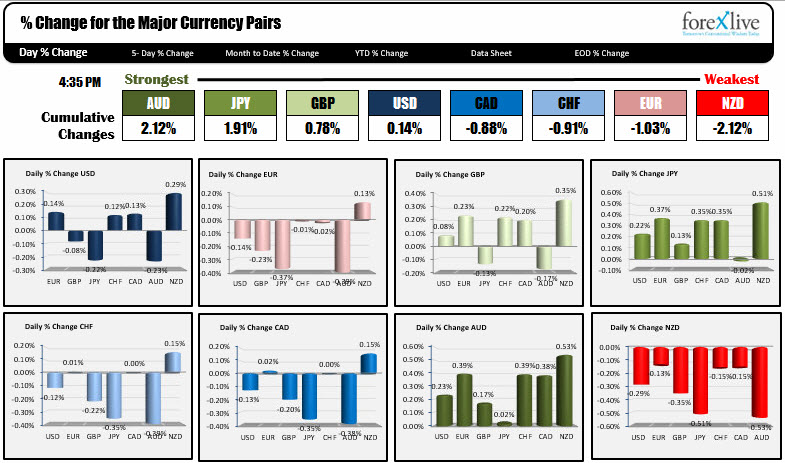

- The strongest and weakest currencies as NA traders enter for the day

- Canada Dec housing starts 207.0K vs 190.0K expected

In other markets:

- US stocks were mixed with the S&P ending the day unchanged. the Nasdaq up 0.36%. and the Dow down -0.16%

- US bonds yields were up about 0.5 to 1.1 basis point.

- Crude oil was down by over 2% on continued OPEC production concerns

- Spot gold was up about $7.00 or 0.59% on Brexit concerns and a slowing dollar

- European stocks ended the session mostly higher. German Dax up +0.17%, UK FTSE uo +0.52%, France CAC unchanged, Spain Ibex -0.43%, Italy MIB +0.33%.

The NA session was low on news. The final wholesale inventories for November rose by 1.0% vs 0.9% at the last estimate. JOLTS job openings was little changed.

Little other news - and an up and down market into the session - had traders continuing that trend and buying low and selling high, in relatively narrow trading ranges.

- The EURUSD trading range was only 76 pips (the 22-day average is 109).

- The GBPUSD traded in a 83 pip range (average 119 pips).

- The USDCHF was 67 vs 87 average.

- The USDCAD was 65 vs 92 pip average.

The exceptions were the

- NZDUSD which had an 89 pip range vs its 74 pip average and the .

- USDJPY which had a respectable 115 pip range.

However, even the more active pairs traded higher and lower in the NY session. I

EURUSD:

The NA session in the EURUSD started near at the days lows. A rally higher took the pair to a session high near the 1.0600 level. From there a reversal lower took the price back down to the 200 bar MA on the 4-hour chart at 1.0550. Yesterday the MA was breached to the upside and started a rally higher. So the retest is a key test for those buyers. The pair has been trading higher and lower over the last three trading days in a range from 1.0508 to a high of 1.0627. The MA sits near the middle of that range.

USDJPY:

For the day, the USDJPY was down and up and down and up and down and up. At the highs of the NY session, the pair stalled against the midpoint of the move down from yesterday's high at 117.525 to the low today of 115.188 (at the 116.35 level). The low for the session stalled ahead of the Asian session low of 115.188 (low reached 115.275). Appropriate to the price action today is that the price is closing near the midpoint of the days trading range at 115.76. In the new trading day, the 200 bar MA on the 4-hour chart at 115.50 is support. ON the topside, the 100 hour MA at 116.28 (and moving lower) will be resistance.

GBPUSD

The GBPUSD had a ceiling from the trading action over the last two days at the 1.2179 level Around the London close, that ceiling was broken and the price extended the day's trading range by above 10 pips to 1.2189, but that was it. The price wandered back lower frustrating the buyers. Toward the end of the trading session, the price recovered back toward that old ceiling for yet another test. So far that ceiling has kept a lid on the pair.

USDCAD

The USDCAD has been ignoring two days of selling in Crude oil. Today, crude oil fell by over 2%, yet the USDCAD only moved up by about 17 pips or 0.13%. It is not much but for most of the NY session, the price of the USDCAD was actually lower on the day. The pair has simply been consolidating between 1.3177 and 1.3277 over the last three trading days. That consolidation has allowed the 100 hour MA to catch up to the price (it is currently at 1.3243). That MA will be eyed by traders in the new trading day. Move back above and then the 100 day MA at 1.3258, and perhaps there will be some delayed reaction buying in the USDCAD. Fail to do that, and traders will be looking to take out the recent lows.

NZDUSD

The NZDUSD was the weakest currency today, but in the NY session, the pair rallied off support against its 200 hour MA. The MA comes in at 0.6965 currently (and moving higher). A break will be needed to push this pair lower. On the topside, the pair is closing right near the 100 hour MA at 0.6994. A move - with momentum above - will have traders thinking that the up and down trading seen since Thursday, will continue. Topside resistance at the 200 bar MA on 4-hour chart at 0.7031, and the 50% of the move down from the Dec 14 high. That level comes in at 0.7050.

The USDCNH tests its 200 hour MA and 61.8% retracement. Will sellers come in (see post here).

The USDMXN moved to new all time highs. Click here for a look at its technicals.