Forex news for US and Canada trading Thursday November 10, 2015

- US stocks give back some of gains into the close

- Facing your trading daemons

- US Retail Sales, PPI and Univ of Michigan confidence are the major upcoming releases

- ECB's Weidmann: Weak euro adds to German current account surplus

- US sells 30-year bond at 2.978%. Above WI at 2.975%

- The on again/off again EURGBP relationship continues

- US household net worth fell 1.23 trillion in the 3rd quarter

- Special discount: Forex t-shirt sale ends today

- Cable completes the roundtrip, what's next

- Gartman is back on the bear trail as oil dumps again

- SNB's Jordan: There is no internal threshold for intervention

- How about that weather

- Canada Oct new housing price index +0.3% m/m vs +0.1% m/m exp

- Canada Q3 capacity utilization 82.0% vs 82.0% expected

- US initial jobless claims +282K vs +270K expected

- November 2015 US import prices -0.4% vs -0.7% exp m/m

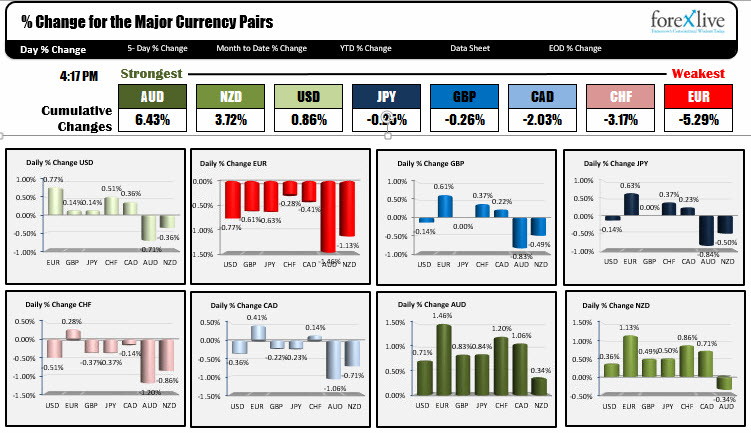

After yesterday's dollar tumble that saw the EURUSD move above the 1.1100 level, and the USDJPY to near 121.00, today was corrective in some currencies vs. the greenback, for others the dollar weakness continued, but for most the changes were minimal.

The one exception might be the EURUSD which saw some selling pressure, but with all/most of the action occurring before NY traders entered. For the North American session, the pair had a corrective move higher after initial claims data was not bad but not great either. That move stalled and a new low was made at around the London fixing time. The rest of the day was spent trading up and down in a 25 pip trading range. The sellers from the 1.1000 level are hanging in there with the 1.0900 -05 area the next target (100 hour MA is at the level) if the sellers can keep the pair below the 1.0955 area.

The GBPUSD had the BOE decision to contend with early in the NA session. After an initial quick dip after the statement (to the 1.5100 area), the market ripped back higher (about 80 pips). The quick action was enough to discourage the traders who seemed more intent on not getting in trouble, then creating some action. The rest of the day was spent going sideways to down. I will say, the EURGBP sided in the favor the GBP over the EUR for most of the day, and sold off back to the 100 day MA at the 0.7200 area (key support). There was a 15 or so pip move higher off that key support level which helped to pressure the GBPUSD a touch lower into the close (don't read too much into it though. It was not a lot of action).

The USDCAD was influenced once again by the price of oil which made new year lows today. That was enough to send the USDCAD higher (the loonie lower) and also the pair to fresh 11 year highs.

The AUDUSD soared in early Asia-Pacific trading after the 2nd consecutive strong employment report. That rally gave way to a correction on market skepticism(?). In any case, the pair corrected to the 200 hour MA and looked to move back higher. but that move stalled, and the pair reached a new NA session low toward the end of the trading day. If 70K new jobs can't hold a bid, it makes you wonder what a -10K number (the estimate) would have done? We will see what happens in the new trading day.

And then there is the NZDUSD which saw the RBNZ cut by 25 basis points and instead of falling, it raced to the upside and kept most of the gains during the trading day.

The highlights over the next 24 hours will include the US retail sales, PPI and Univ of Michigan confidence but that is not until tomorrow NY session. With NZD PMI out already, you can look forward to a December Friday I guess. Have a great weekend!