Forex news for March 30, 2015 US edition:

- US Core PCE comes in at 1.4% y/y vs 1.3% y/y expected

- US Feb personal spending +0.1% vs +0.2% expected

- US Feb pending home sales +3.1% vs +0.3% m/m expected

- Goldman Sachs cuts Q1 GDP tracking to 1.2% from 1.4%

- Canadian Feb industrial product price +1.8% vs +0.9% expected

- March 2015 German HICP flash +0.1% vs +0.1% exp

- ECB sovereign QE tally rises to €41 billion

- Saudi Arabia says to step up airstrikes

- US sees '50-50' chance of Iran deal - State Dept

- Tsipras: Greek debt needs restructuring in order to be repaid

- Gold down $13 to $1185

- WTI crude down 13-cents to $48.74, erasing earlier losses

- S&P 500 up 25 points to 2086

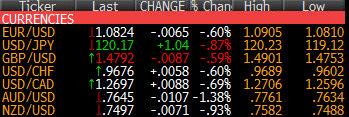

- US dollar leads, Australian dollar lags

The US dollar started higher and Europe and didn't stop. Traders struggled to find a good reason for the rally. Yellen's comments on Friday were more dovish than anything and there wasn't a good reason in the news to buy the dollar.

Instead, everyone was looking at the calendar with dollar demand likely a function of the turn of the calendar. A big mover was USD/JPY as it climbed to 120.20 from 119.20 just as dollar bears were beginning to get excited.

EUR/USD was less of a one-way street but chopped down to 1.0810 from 1.0840. The headlines from Greece weren't a factor.

On currency with a positive catalyst to start the week was the Australian dollar after some dovish comments from the PBOC on the weekend but the market wasn't interested and AUD/USD fell more than a full cent to 0.7652. Some bids below are holding but AUD bulls have quickly gone back into hiding.

Cable hit some stops below 1.4775 but found bids at 1.4750 and rebounded. A little squeeze up to 1.4843 followed then it sagged back to 1.4800. There was lots of election talk but the driver was a thin market with plenty of flows.

The loonie rallied on falling oil prices but even when oil rebounded on a squeeze into the settlement, the loonie couldn't make any headway. I suspect that with oil settlement out of the way and a soft GDP likely coming tomorrow, it's open season on CAD.