Forex news for May 22, 2015 US edition:

- Fed Chair Yellen: Rate rise at some point this year is appropriate, 'we are not there yet' on employment

- The Outlook for the Economy - Full text of speech by Janet Yellen

- April 2015 US CPI -0.2% vs -0.1% exp y/y

- Core 1.8% vs 1.7% exp y/y

- Canada April CPI 0.8% y/y vs 1.0% y/y expected

- Canadian March retail sales +0.7% vs +0.3% m/m expected

- Only one oil rig went offline this week - Baker Hughes

- Merkel tells Tsipras there will be no deal without the IMF - FT

- France's Sapin says there's no plan B for Greece

- S&P affirms Swiss rating but says the SNB lifting the franc cap will hit growth

- Plus500 shares smashed again, still catching up on the paperwork to unfreeze accounts

- FXCM to acquire CitiFX Pro accounts

- S&P 500 down 5 points to 2126

- Gold flat at $1206

- WTI crude down 78-cents to $59.94

- US 10-year yields up 2 bps to 2.21%

- US leads, GBP lags on the day

- USD leads, EUR lags on the week

A fractionally strong CPI was all it took to spark a massive dollar rally. It was as clear of a sign of underlying demand as you will ever witness because the number was barely out of line.

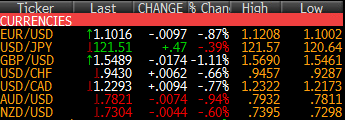

EUR/USD had touched 1.12 in European trading and was at 1.1175 when the number hit. It plunged to 1.1100 quickly and then ran stops at the European low and yesterday's low in a rout that finally found support at 1.1002. There were a few tries at the big figure but they held, at least so far. There was talk about option expiration weighing but there was no sign of demand afterwards.

The drop in cable was equally dramatic and completely wiped out a gain on Thursday after retail sales. GBP/USD plunged to 1.5575 from 1.5635 on the number and then secondary sellers kept the momentum going to 1.5500. A break there eventually gave way to even more selling down to 1.5459 before a late, 30 pip bounce.

USD/JPY was a touch less dramatic as it jumped to 121.50 from 120.90 but these are some lofty levels in the pair and Yellen's optimism points to the chance of rate hikes. The pair has gained in 6 of 7 days and this is the highest close since 2007. The March intraday high of 1.2203 is the next target.

USD/CAD caught a strong bid despite good retail sales numbers in Canada. A drop in oil prices helped the pair in an initial move to 1.2260 from 1.2200. That was followed by persistent buying to 1.2322 before a late dip back to 1.2293 as oil bounced into the weekend.

AUD/USD sold down to 0.7840 from 0.7885 on the CPI numbers. Yellen added a touch more selling and sent the pair to a fresh low of 0.7811. It was one of the few pairs to make fresh extremes after Yellen; most just went to retest the previous levels.

Reminder: It's a long weekend in the US and parts of Europe, so Monday will be awfully quiet.