Forex news for US trading on October 6, 2015:

- August 2015 US trade balance -48.33bn vs -47.40bn exp

- August 2015 Canadian trade balance -2.53bn vs -1.20bn exp

- Schaeuble says Spanish economic figures are improving

- EIA raises 2015 world oil demand forecast by 170kbpd to 1.34mbpd

- New Zealand Fonterra dairy prices +9.9%

- IMF cuts global growth to 3.1% vs 3.3% prior

- Don't panic about inflation says ECB's Liikanen

- September 2015 Canadian Ivey PMI 53.7 vs 54.0 exp SA

- October US IBD TIPP economic optimism 47.3 vs 44.5 exp

- Goldman Sachs lowers GDP forecast after trade balance

- Irish central bank shortlist down to two candidates

- Gold up $11 to $1147

- WTI Crude up $2.58 to $48.85

- S&P 500 down 7 points to 1979

- US 10-year yields down 2.5 bps to 2.03%

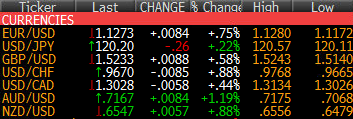

- AUD leads, USD lags

EUR/USD gained about 50 pips in US trading in a steady morning climb higher and flat trading around 1.1270 in the US afternoon. The gains fell short of Monday's high of 1.1290 but not my much. The gains were more about broad USD weakness than anything euro-related.

Cable is a similar story as it challenges Monday's high of 1.5244 and so far has fallen just a couple pips shy. The gains were modest until US traders arrived and started to sell USD.

USD/JPY was a bit of an exception on the sell-USD theme. It finished lower but the damage was done in Asia when it hit a low of 120.12. A second wave of selling after the European close touched 120.10 but there was no follow through.

The big story was commodity FX. NZD/USD got a lift from the dairy auction but the entire bloc was bid. For CAD and AUD it was the fifth consecutive day of solid gains.

WTI crude helped the loonie. A higher global demand forecast and the API numbers late helped crude to a big gain and the highest trade since Aug 30. Watch $49.33, which was the late-Aug high.