Retail sales awaited

The US retail sales will be released at 8:30 AM ET. The expectation is for the headline to come in at +0.2%. Ex-auto is estimated to decline by my 0.1 (vs. +.1% in August). Ex-auto and gas is supposed to gain +0.3% (vs. +0.3% in August). The control group is expected to rise by +0.3 vs. +0.4% last month.

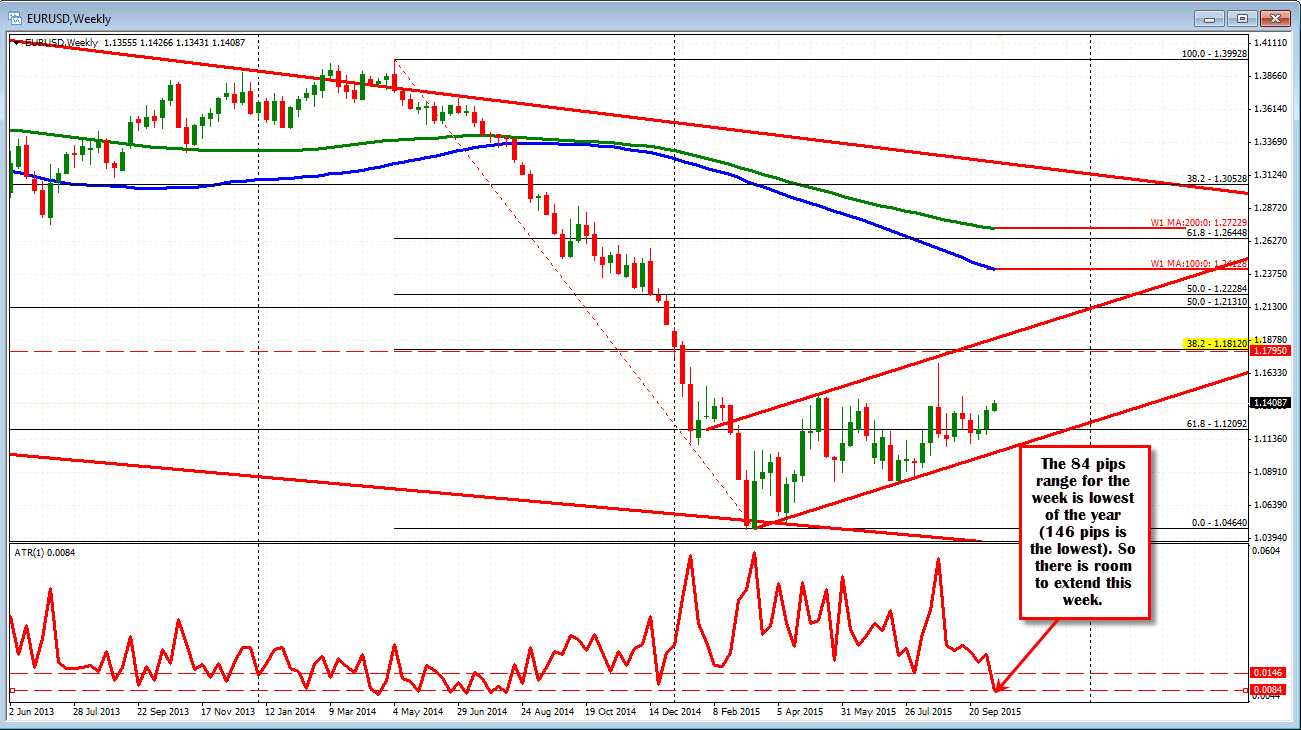

The EURUSD is in a narrow 50 PIP trading range today. For the week, the range has been extended to 84 pips as EURUSD traded to new month highs (highest level since September 18th). At 84 pips for the week, there is room to roam and extend the trading range. For your guide the lowest trading range for a calendar week this year was 146 pips. We are more than 1/2 way through the current week. Look for a break and run.

Looking at the hourly chart, the pair closed yesterday at 1.1378. Although the price advances have not been great this week, the pair has risen on each day if the price closed higher today (yesterday's close was at 1.1378), it would also be the 5th straight up day (that run took the price from 1.1233 to 1.1426 or 193 pips). The topside today stalled at a trend line connecting the recent highs over the last 4 trading days at the 1.1426 level. A break of this level should open the door for further upside momentum (the range is only 50 pips vs 106 pip average over the last 22 days). The price has backed off pre-data, and trades around the 1.1400 level (dipped to 1.1390).

ON the downside, there is a lower trend line connecting recent lows over the last 4 trading days at 1.1369 currently (and rising). The 100 hour MA (blue line in the chart below) comes in at 1.1353. The price has not traded below the 100 hour MA since October 7th (failed break). A move below this level will give sellers more confidence of a break and run potential.

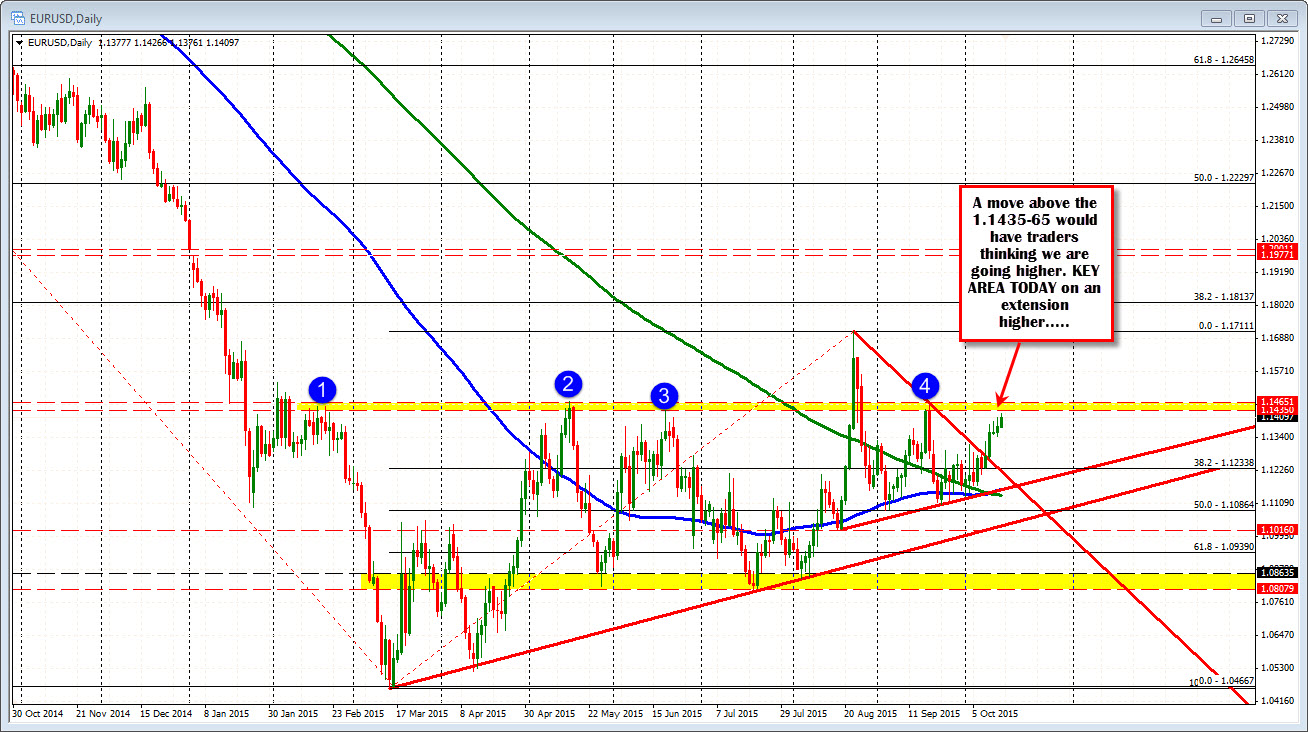

Looking at the daily chart, the pair is approaching an area where there have been swing highs over the last 8 months. That area comes in between 1.1435 and 1.1465. In that range, there have been swing highs in Feb, May, June and September. In August on the infamous Dow down 1000 day, the pair broke higher, but was back below 2 days later. This is a key level today on any move higher. Be aware (see chart below).