Everyone knows the NZDUSD will rally after the RBNZ cut today. So go early...

The story in the NZDUSD today seems to be that EVERYONE (read a bit of sarcasm in "EVERYONE") knows that the NZDUSD will rally even though the RBNZ will cut rates today. After all, that is what the AUDUSD did after the RBA cut last week. Furthermore, everyone knows that the trading story is about yield hunting. The cut today will bring the short term rate in NZD to 2%. That is huge. Looking at the 10 year yield, Bloomberg has the NZD 10 year yield at 2.148%. That is huge too. So carry trade it is. Buy the dips.

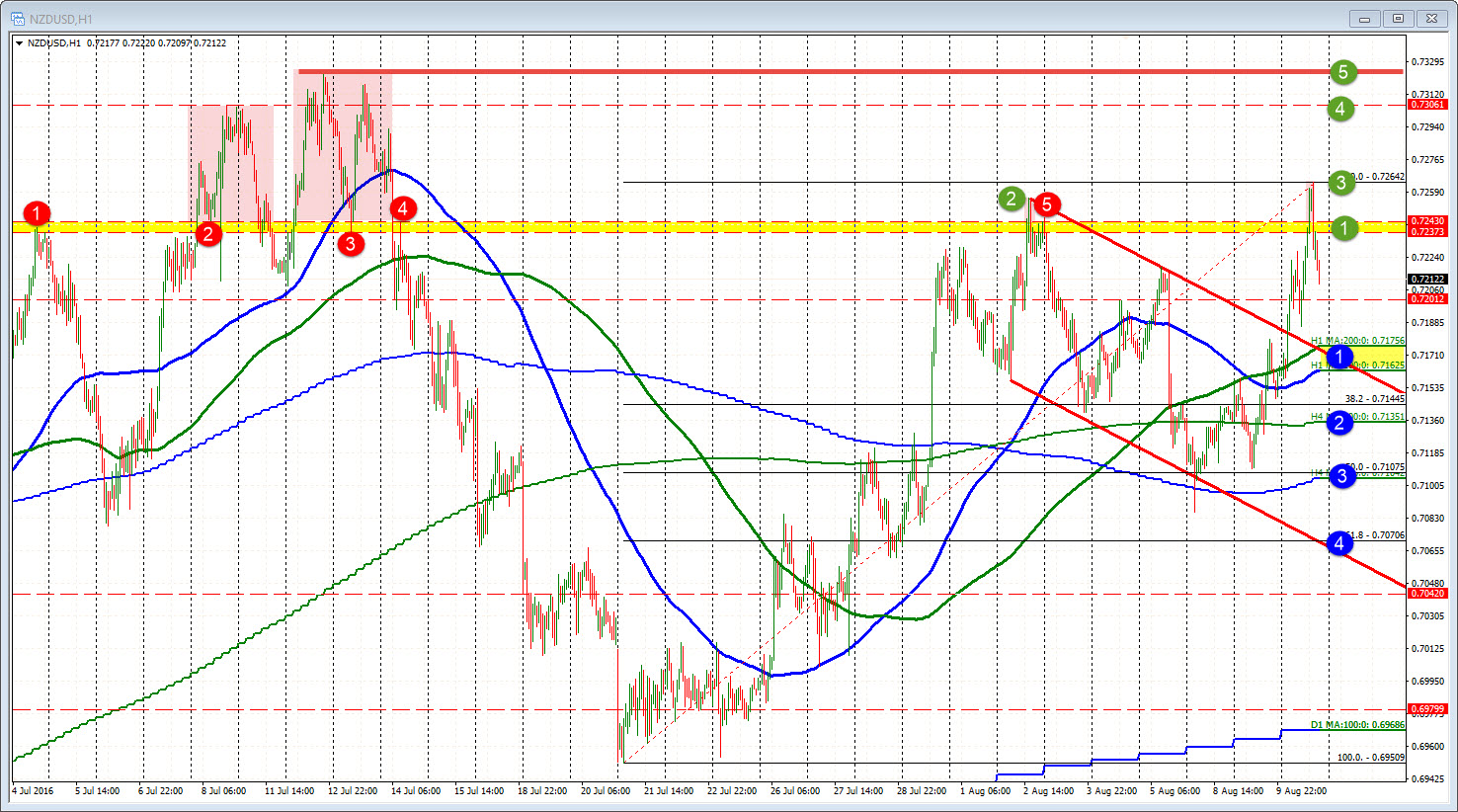

Today everyone knows the story, so why not get a head start. The NZDUSD rallied from the start and in the process has seen the price take out the August highs at 0.7255 (green circle 2). The high reached 0.7264 (green circle 3 in chart below). The recent high close (from July) is 0.7299 (green circle 4 in chart below). The high for the year (and going back to May 2015 is 0.7324 (green circle 5). Those are targets to get to and through.

So we all know it will go higher, but will it? That is the dilemma that traders always face and we have seen a move lower over the last few hours as a way to keep traders honest. There is always that chance that the certainty, is not really a certainty after all. And when that happens the late comers to the party will trade near the extremes and will feel the pain of a correction. That is what we seem to be seeing over the last few hours and the price rotates back lower after taking out the August highs.

Now, the price may indeed rally like a mother after the announcement later this afternoon, but......the RBNZ may look to mitigate the "sure thing" trade too. After all, the terms of trade from a currency rally mitigates stimulus from a rate cut and lowers inflation even more. They want to see inflation start to rise.So Governor Wheeler may be more dovish. He may cut by more than 25 basis points (37.5 or 50 basis points). He may steer talk toward further cuts. How the market takes that, I don't know but longs from above, may not like the feeling.

What if you trade after the risk event? Now that is a smart move given the risk for more with the currency so high. There are some technical levels that are worth watching for clues.

On the downside, if the story is a 25 basis point cut and talk from Wheeler, there may be a dip that sees the 200 and 100 hour MAs tested at 0.7163-75 area (see blue and green lines in the chart above and blue circle 1). The underside of the broken trend line is also near that area as is the 50% of the move up from the weeks low. Risk could be defined and limited there. I would expect buyers to show up there to see if there is that bounce and move higher that all are looking for and there are a lot of technical reasons to think it will. What if it does not?

More patient buyers may lay low in the weeds and wait for the 200 bar MA on the 4-hour chart to be tested at 0.7135 (at blue cirlce 2 in the chart above) or the 100 bar MA on the same 4-hour chart at the 0.7104 level (blue circle 3). This is near the 0.7100 level.

Earlier in the week the price traded below the 0.7100 level (on Monday) for about 15 minutes. That's it. Moreover, the low on Tuesday got to 0.7109. The 50% of the move up from the July 20 low comes in at 0.7105. So that too would be a key patient area to lean against on a dip. It might take 25 basis points and Wheeler saying another cut will occur at the next meeting. Getting to 3 may even come on 37.5 cut.

If that level does not hold, the 0.7070 level will be targeted (blue circle 4).Can it get there on 50 basis point cut? Sure. It was near that level on Monday (low at 0.7084).

The reality is know one knows what will happen, where the price will go, and how that road will be traveled. What we do know is there are some key levels that will give traders clues and a bias. It is the wise trader who keeps their nose clean, waits for the risk event (and liquidity risk) to play out and look to react against key level with risk defined and risk limited.

The final option is to step aside, not trade the risk event at all and pick your next trade where risk is lower and more to your liking.