Looks to test the 100 hour MA

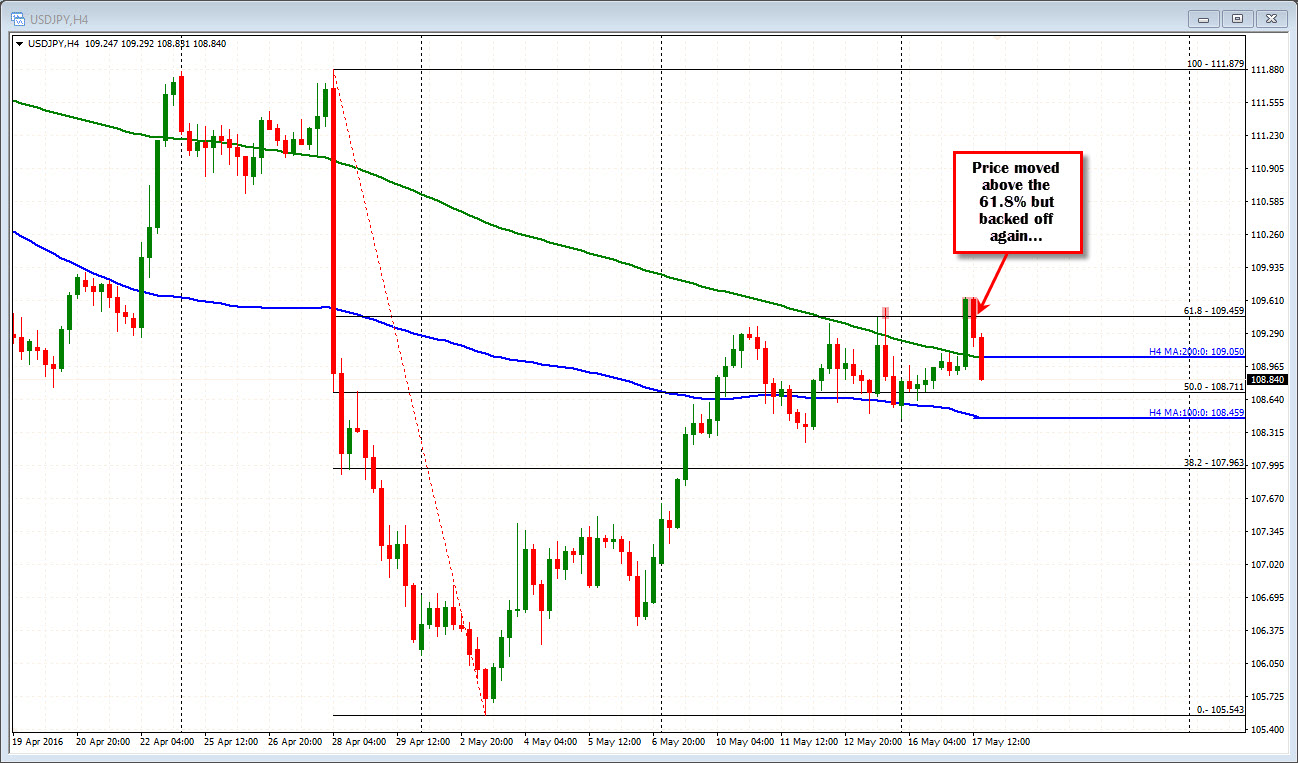

The USDJPY failed on the break above the 61.8% of the move down from the pre-BOJ meeting high (on April 28th -see chart below).

The move lower has sent the pair below the close from yesterday at 109.01 (we are now down on the day in the pair).

The market is back in the non-trending range defined by the 108.218 level below and the 1.0946 level above (the 61.8 retracement level). There have been two failed looks above the topside extreme and 3 hourly closing bars over the last 6 trading days (see hourly chart above). The midpoint of the 6-day range is 108.93. The 100 day MA is at 108.874.

When the market non-trends, the trading action is often characterized as choppy. That is what we are seeing. Eventually, the pair will break and run. Today's break higher should have done just that, but it was not to be. So traders gave up on the move back below the 109.36 as buyers turn to sellers. It wasn't like the US data was all that bad, it seems to be a case of it not attracting more buying of the dollar.

Trade extremes. Be patient. If the market fails get out. If you have profit, don't be greedy. Look for a "real break" at some point.

I did a video on "Attacking Currency Non-trends" which can be found HERE.