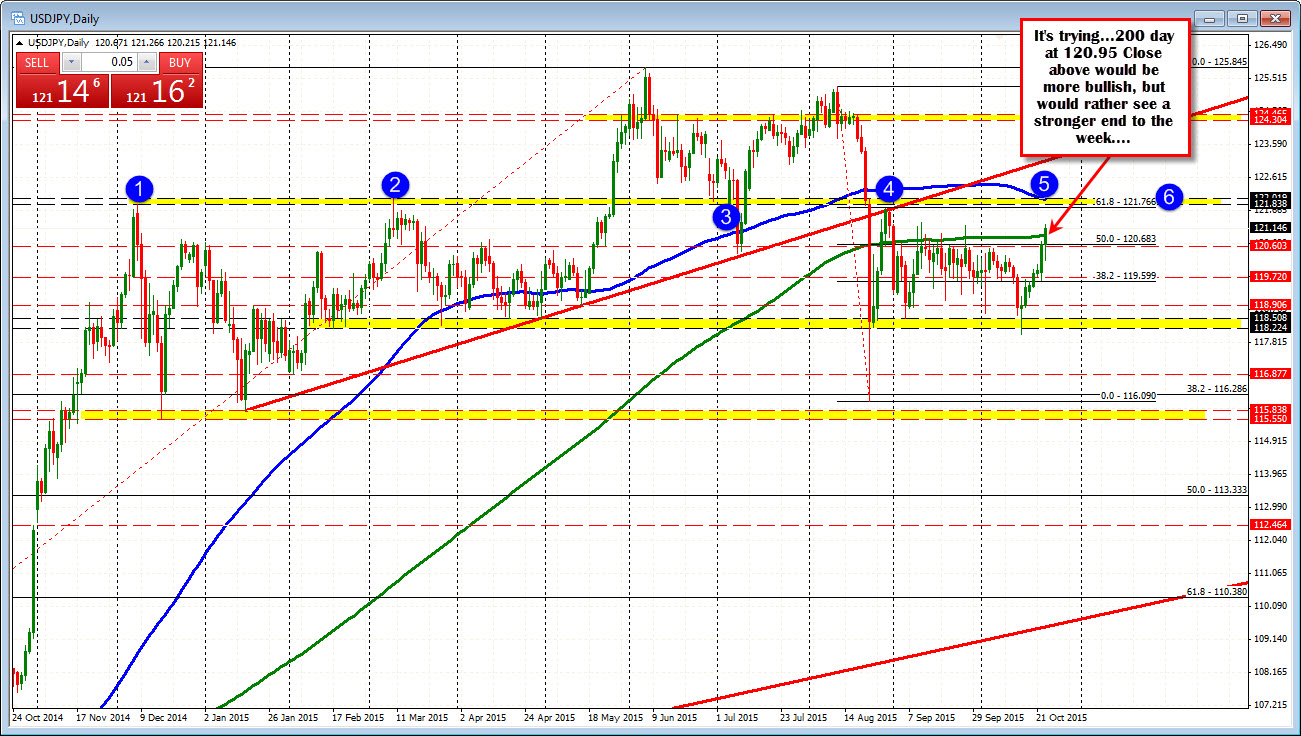

Closing above the 200 day MA for 1st time since August 31

The USDJPY is a few hours a way from doing something different. In September, the price of the pair tried 5 different times to close above the 200 day MA. Each attempt failed.

The current price is above that level. So if the pair can close above, it would be something different (kinda like Sesame Street's "One of these things is not like the other).

Now, being greedy, you want to see a break and run. A break of the 200 day MA at the 120.94 level, a move to 121.26 is a step in the right direction, but a close at 121.02 would not be a ringing endorsement into the weekend. In fact the high print in September was 121.319. So we have not even reached that target yet.

So if I had my way, a close above 121.31 would feel much better. Wouldn't it? That would look much better technically and traders could look forward to the next hurdles between 121.76-122.00 where there is more upside resistance (61.8% retracement at 121.766, 100 day MA at 121.97, swing highs from Dec, March, August, etc). That will be another nut to crack if the buyers are to start taking us to the upper levels of the years trading.