Stretches above MA as NY traders enter

The USDJPY has pushed higher again today after a break yesterday. Corporate tax cuts in Japan and a Nikkei rise of 7.71% helped the pair. Talk of BOJ trimming inflation and growth has traders piling in.

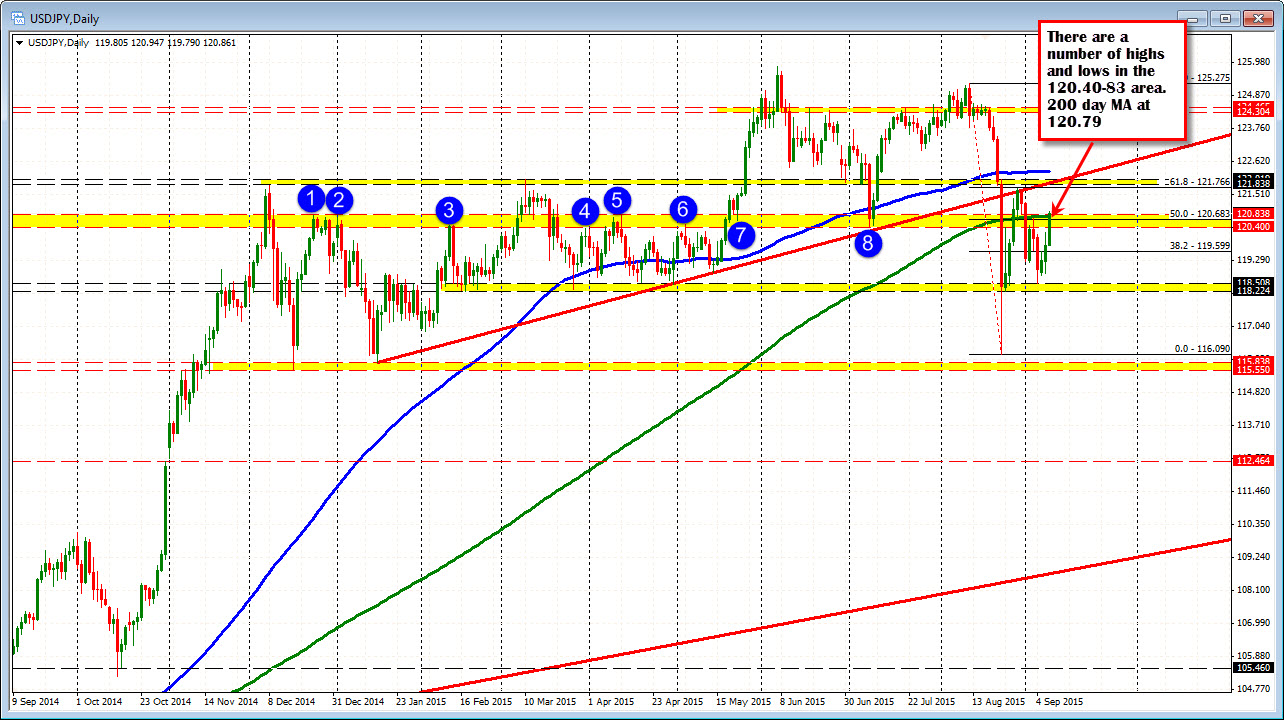

Technically, the pair today has pushed above the

- 200 hour MA (green line in the chart above) earlier in the Asia-Pacific session at the 120.12 currently.

- Then the 120.40 low from July (see daily chart below)

- The 50% of the move down from the August high was broken at the 120.683

- Now the 200 day MA at the 120.796 is the next hurdle overcome. The 120.83 is also an old ceiling on the daily chart (see daily chart below)

Traders will be eyeing the 200 day MA as close support now. A move below does not end the bull run but it may just lead to more corrective forces on the disappointment.

The 5 minute chart below shows the tracking of the price against the 100 bar MA. The biggest correction occurred as the price got close to the 200 day MA and found sellers. If there is a move back below the 200 day MA look for support at the 38.2-50% of the last leg higher and then the rising 100 bar MA.

On the topside, the 121.39-41 is an upside target over time (see daily chart) and then traders will have their sights on 121.830-122.00 (see daily chart). The high price going back to December 2014 came in at 121.83. The high price in March was 122.01. In between is the underside of the broken trend line (see daily chart).

Let's see if the buyers can keep the price above the 200 day MA first....