Philly Fed and Dudley awaited

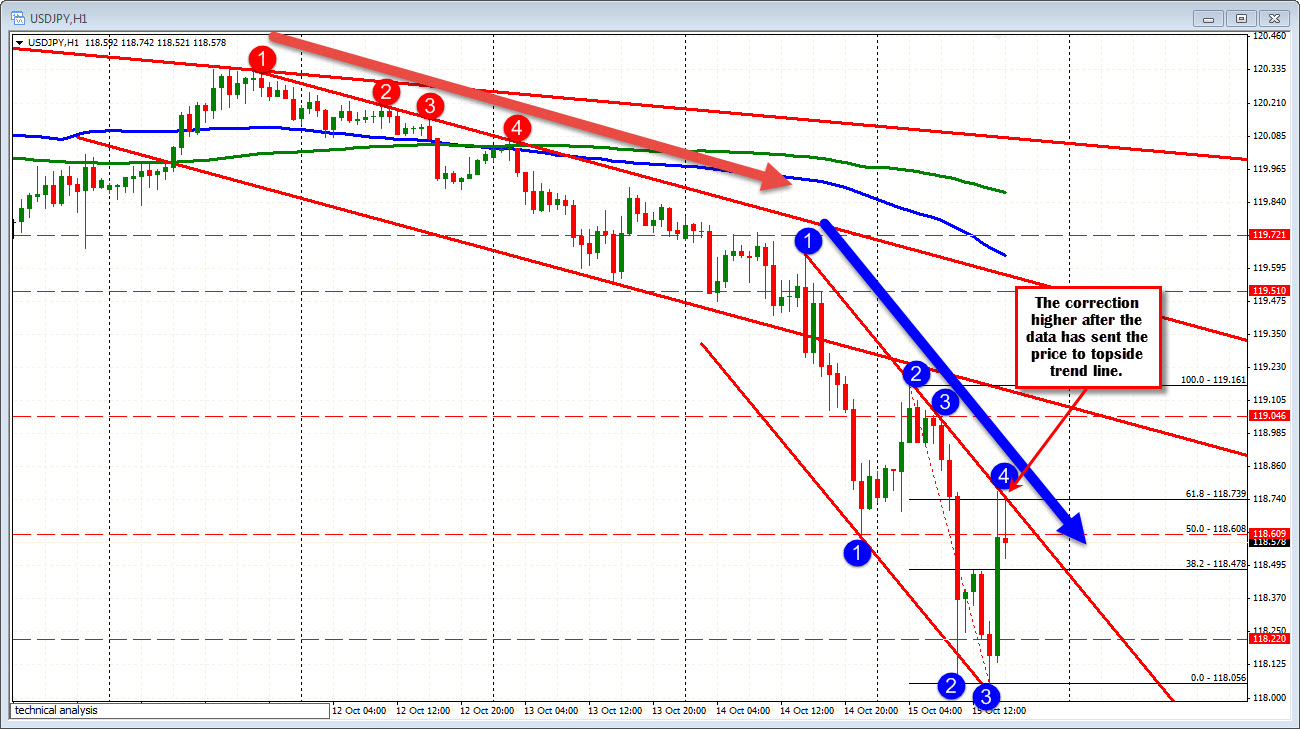

The USDJPY has found it's channel (see chart below). The topside channel line has been tested and held on two separate occasions. The lower trend trend line has also found buyers near the line on a couple tests today.

The problem is the better data today (vs weaker data yesterday) sends us into the next major releases and events with more caution. Philly Fed index at 10 AM (was -6.0 last month - expecting -1.0 this month. Last month was a surprise to the downside) and then Fed Vice Chair Dudley at 10:30 AM will be telling.

Back on October 9th (Friday), he said that the "key question is, are we want to get sufficient growth in the economy, put down pressure on the employment rate, get an acceleration in wages". He added "if we get that, I'll be reasonably confident inflation returning to 2%". He also said all meetings are "live" and that "he still forecasts a rate hike this year" but warned that "it's a forecast and were going to get a lot of data between now and December, so it's not a commitment".

Since then, retail sales, PPI and inventory data was weaker yesterday. The jobs data was better today along with CPI.

The Fed has continued confuse vs. make clear. Dudley being the Vice Chair has the potential to state Fed's intentions more clearly - without the "yeah, but" caveat. But he always seems to have those "buts" included.

So for traders, risk is up and although the technicals are showing a nice picture with support below at a lower trend line, and resistance above against a higher trend line, the uncertainty from what spews from the mouth is still a big question mark.