Yesterday's attempt higher was not so impressive

The USDJPY price took out the 200 hour moving average for the 1st time since December 18. it took out the 38.2% retracement of the move down from the December 30 high. It took out the previous day high and that break was worth a 10 pip rally. That's it? The buyers gave up.

The price today has moved lower in response to that failure and more failures in the global stock markets which are once again falling after yesterday's bounce back. Oil price have also pushed to new lows with the Shanghai composite down 3.55%, the UK FTSE down 1.47%, German Dax down 1.24% and the French CAC down 1.58%. US S&P futures are down 30 points in pre-market trading.

Technically, the price of the USDJPY has moved lower but has stalled at a support area where there has been a number of swing lows over the last 5 or so trading days. That area comes in at 117.188-32. Key test . We are breaking through that support as I finish up....

Yes. the pair is technically consolidating still, but that failure on the break of the 200 hour MA was a huge opportunity for a rally. It did not happen. Is the floor as important? The importance is the market can use the area to define and limit risk. Hold...and the 100 hour MA will be the next target at 117.78. Break....and the low from Monday becomes the focus for the pair.

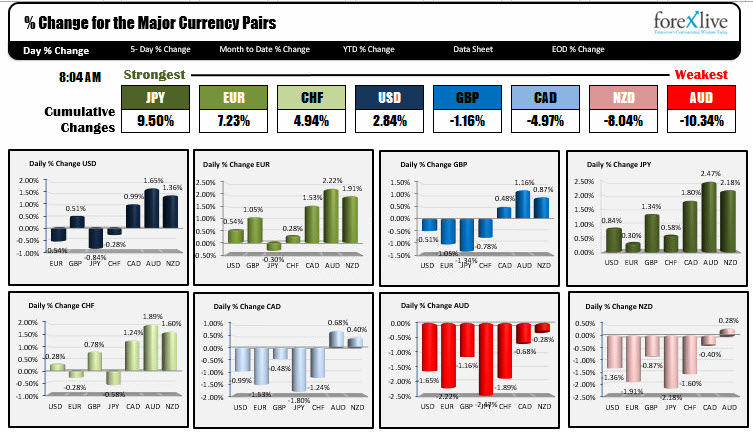

PS. The strongest and weakest currency session shows JPY is the the strongest on flight into safety trade. The weakest currency is the AUD and NZD as the movement out of risk and China concerns leads those currencies lower.