London traders looking toward the exits

The USDJPY has corrected back higher after a move below the 100 hour MA and trend line support failed.

European and London traders are looking to exit for the weekend and the buy back may be related to weekend squaring up.

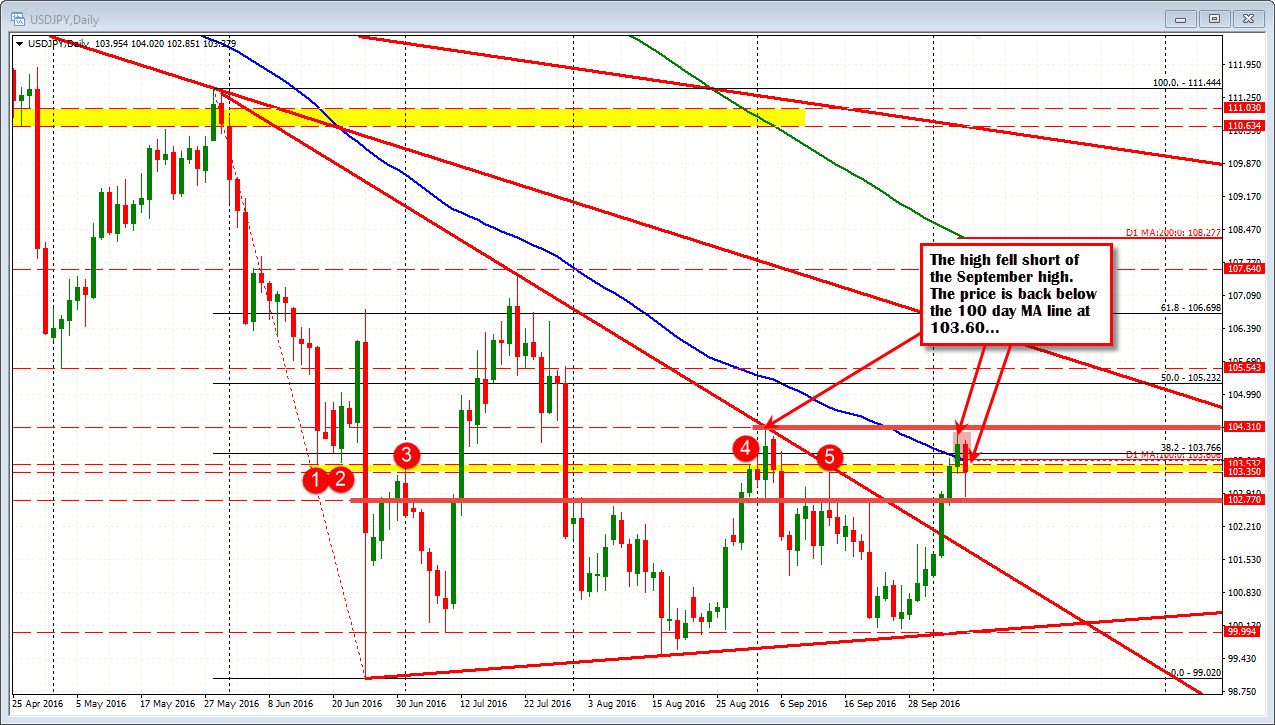

The week has seen the price of the USDJPY move up from last Friday's close at 101.30 to a high reached yesterday at 104.15. IN the process the pair moved above a key trend line near the 102.00 level, the 100 day MA at 103.604. The price also advanced above the 103.35-53 (see red numbered circles) which defined swing lows/highs going back to mid-June. The high price for the week did stall ahead of the September high at 104.31. That hurts the buyers/bulls especially since the price also moved back below the 100 day MA (blue line in the daily chart below at 103.60). PS the break of the 100 day MA was the first break since February so a failure is not what you really want to see).

The pair is currently back up ans testing the 103.35 level (low of the yellow area in the daily chart). If the price can somehow find it's way back above the 103.53 and then the 100 day MA at 103.606, the longs will be happy. The buyers will be back in full control. That break will likely not be so easy on the first look however. Expect sellers on a test.

Overall, a good week for the bulls, but it is ending with the 2 plus month range in tact. That leaves the door open for bulls and bears next week.