Puts some air between 100.00 and the price

The USDJPY has moved sharply higher in trading today, helped by word of additional stimulus measure in Japan. The pair has enjoyed a 200 pip trading range and is up nearly the same from Friday's closing level.

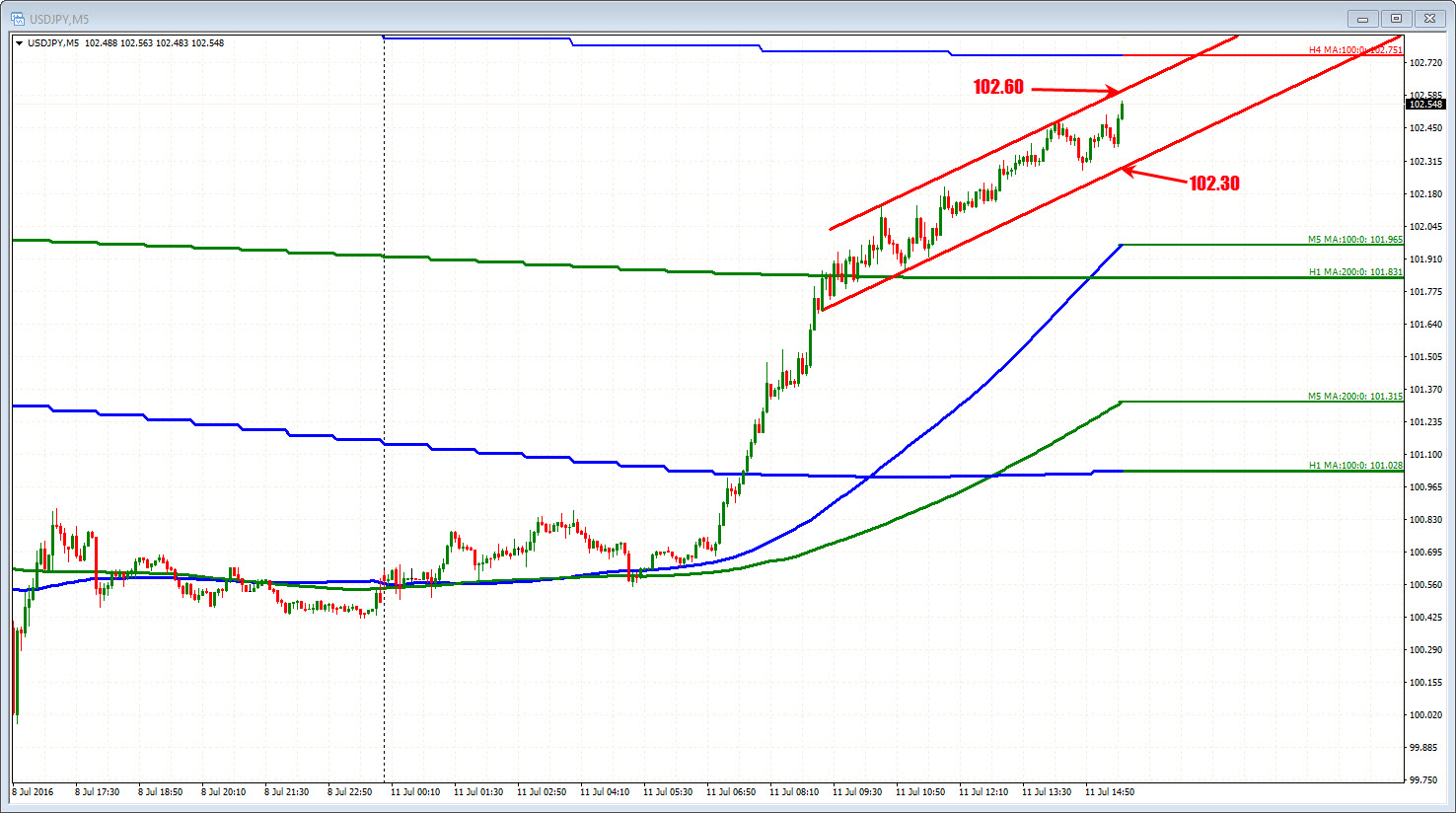

IN the process the pair moved above the 100 hour MA and trend line off the hourly chart at the 101.02 area. The 38.2% of the move down from the post Brexit high at 101.245, the 50% of the same move at 101.635 and the 200 hour MA at 101.83.

The 100 bar MA on the 4 hour chart is the next target for the pair (not traded above since Brexit day and that was only for an hour. The last time it traded above that MA for an extended time period was June 1, 2016). That level comes in at 102.749. The post Brexit day high come in at 103.286 is also an upside target and cannot be ruled out (will likely need some pretty good additional stock moves today). S&P futures are up about 7 points and the Nasdaq futures are up about 22 points in pre-market trading).

Looking at the 5-minute chart, the pair has slowed the momentum at the top but has remained in a channel. The topside trend line come in at 102.60 while the lower is at 102.30 currently. There has been small corrections along the way. Keep an eye on the lower support line now for intraday clues. Stay above keeps the shorts on the defensive. The 100 bar MA - blue line following behind at the 101.98 currently - is another intraday risk level now for the bulls.