Moves above 100 hour MA

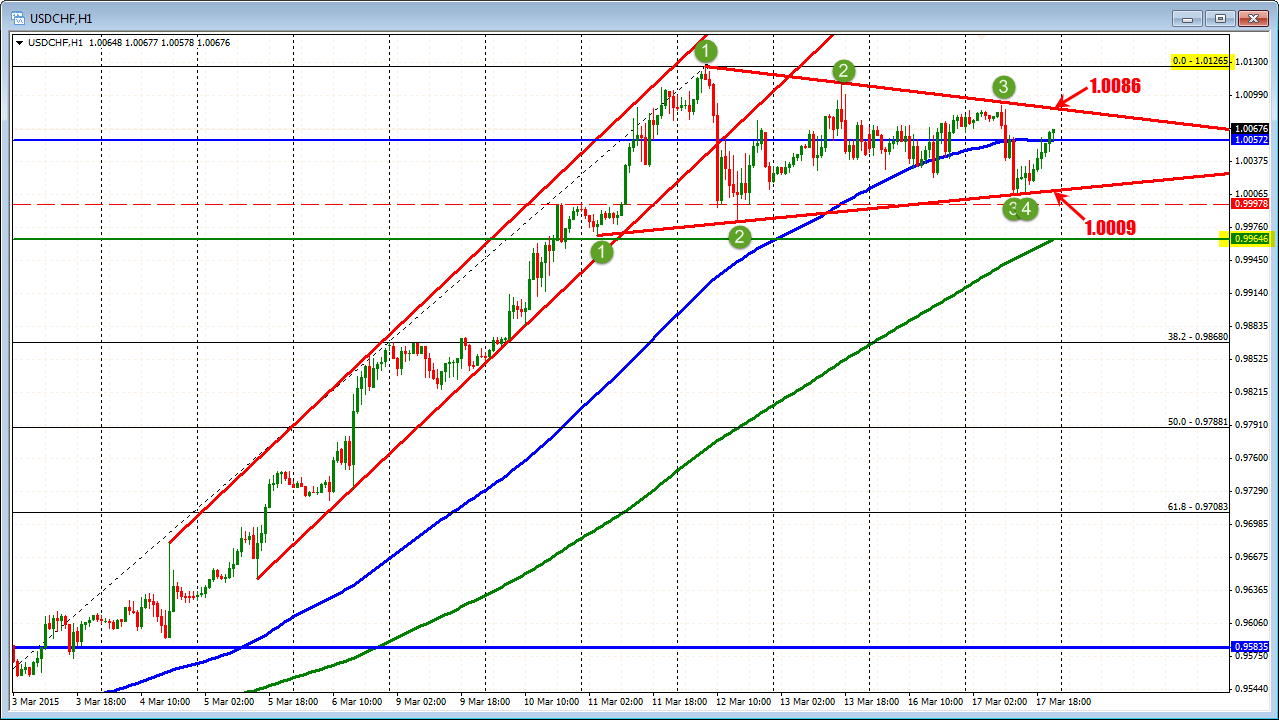

The USDCHF is converging/consolidating/coiling at the highs over the last 5 trading days. In the process the 100 hour MA in the (blue line in the chart below) has flatlined. There is a definitive lower and upper trendline forming a pennant. The topside trendline, comes in at 1.0086. The lower trendline, comes in at 1.0009. Below the bottom trendline, the 200 hour moving average at the 0.99646. The high price - post the SNB de-peg - is at 1.0126. Look for a break of the extremes post the FOMC with increased momentum.

The forex market has been consolidating in a number of currencies as a result of the FOMC decision.

For the CHF, the SNB decision on Thursday is an added risk event.

The SNB is expected to refrain from operations but if there is a risk, it would be to look to weaken the CHF against the EUR through a potential rate cut or threat to cut rates. Although the USDCHF has recovered most of the decline from the SNB decision (within 160-170 pips of the high), the EURCHF remains well below the 1.2000 peg level (currently at 1.0661). As a result, I would expect that any decline in the EURCHF off the FOMC decision (i.e. caused by EURUSD weakness perhaps) will likely find support against the 100 hour MA at the 1.0628 area. That in turn should support the USDCHF in the process.