Capital controls in Greece send traders into CHF (at least for now?)

There are rumors of capital controls in Greece to stem the flow of funds out of Greece The market reaction has been a move into the CHF as a safe haven destination - at least for now. Thinking out loud though, if controls are put into effect, it may ultimately lead to less demand for CHF as a safe haven. This could have the opposite effect then what we are currently seeing (all other things being equal of course).

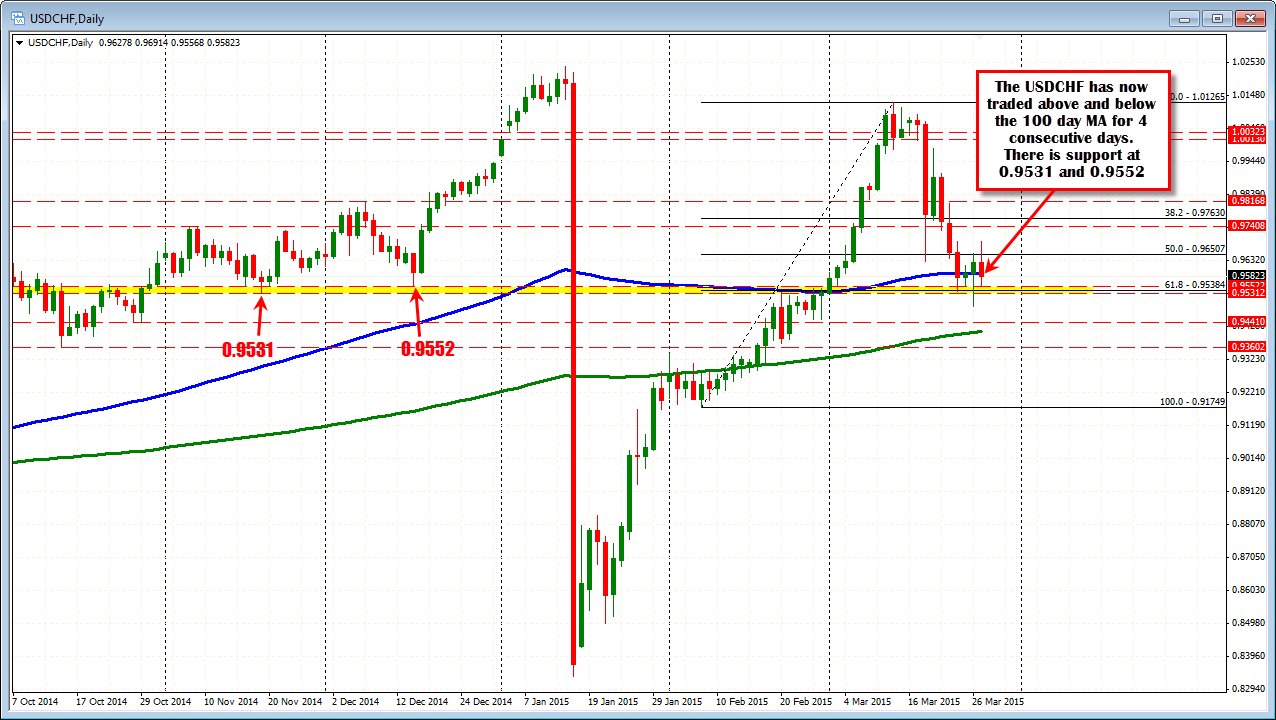

Technically,however, the flows seen in the last few hours, have sent the USDCHF back below the 100 hour moving average at the 0.96108 level ( blue moving average line in the chart below), and also back below the 100 day moving average at the 0.95923 level. The 50% retracement of the move higher from yesterday's low to the high seen today is also at the 0.9591 area. With the price below all these technical levels, the long USDCHF trade idea (see video), was closed out/is on hold.

The next support comes in at 0.9531 to 0.9552. These levels represent the low prices from November and December 2014.

With weekend anxiety, now may not be the best time to venture in the deep end. The key levels will still be in play next week, with both key support and resistance levels in play.