Buyers lean against December lows

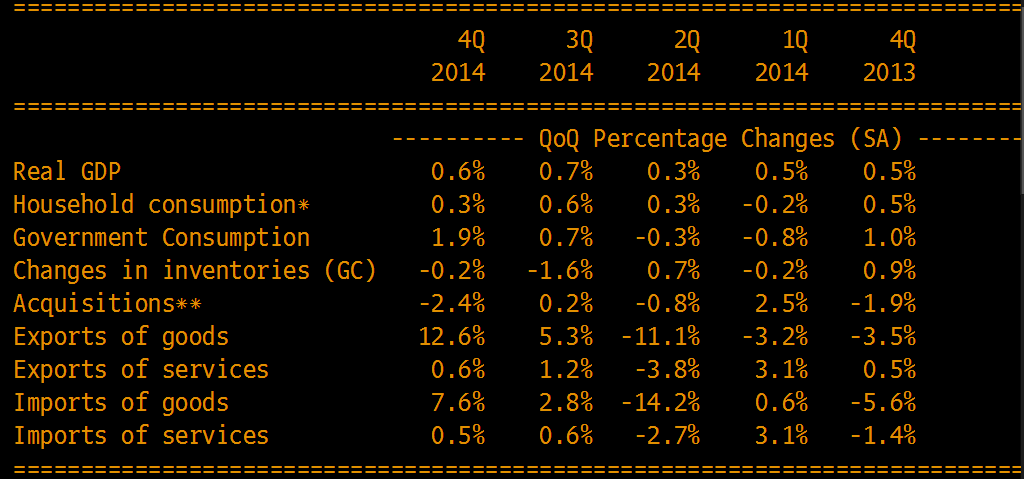

The USDCHF has continued a slow grind higher in trading today. As noted in an earlier post today, the rally today came despite a stronger-than-expected GDP for the 4th quarter of 0.6% vs 0.3% estimate. However, the GDP did benefit from Government consumption which showed a QoQ surge of 1.9%. The numbers are pre- SNB intervention as well.

Below is a table of the recent trends in the major GDP components and the respective QoQ changes.

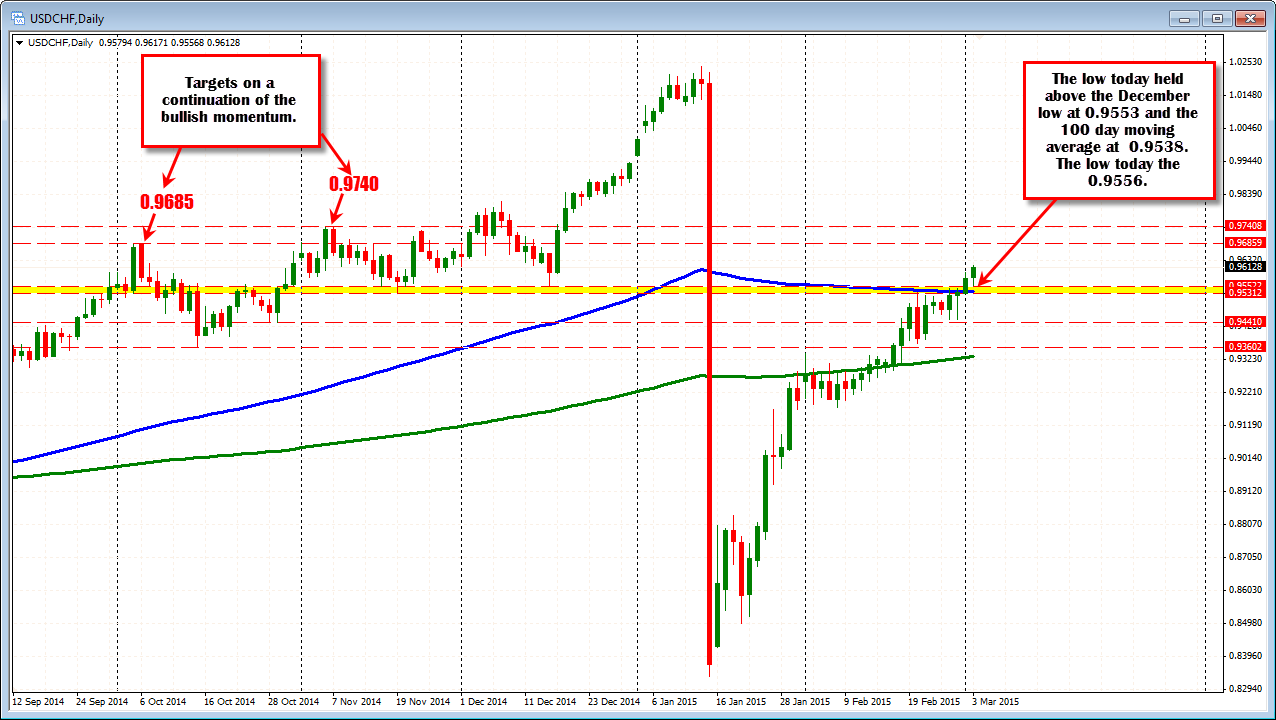

For the USDCHF, the price yesterday, was able to extend above the 100 day MA (blue line in the chart below) at 0.9538. It also moved above the low prices from November (0.9531) and December 2014 (0.9552). The low today bottomed at 0.9556, just above the low from December. The holding of this level, keeps the buyers in control.

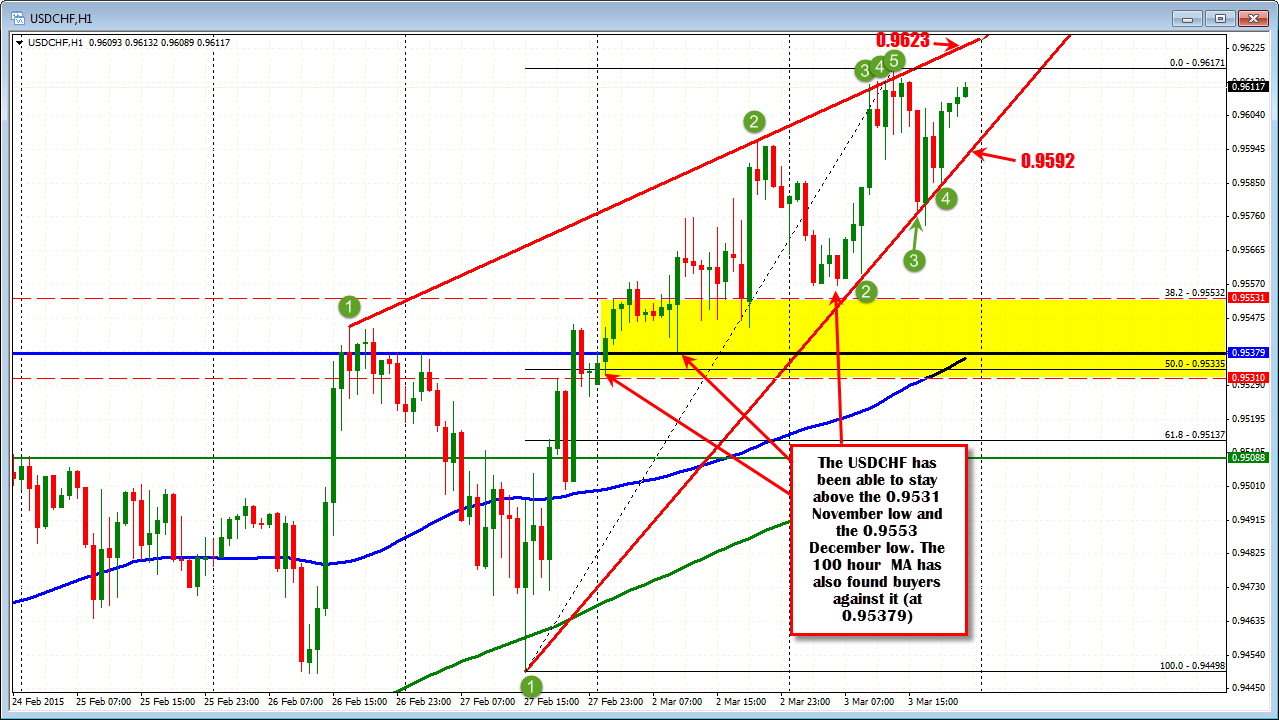

Looking at the hourly chart below, the USDCHF peaked against topside trend line resistance today, and fell down to test the lower trend line in the NY trading session.Support buyers entered in that area and have since pushed the price back up over the last 4 or so hours. The upper trend line comes in at 0.9623 currently (about 2 pips change per hour). The lower trend line is currently at 0.9592 (and rising by 3 pips per hour). Traders should use these lines to define and limit risk.

On a move below the lower hourly trend line, I would expect to see more corrective momentum lower. However, I would still expect dip buyers to show up. As long as the price remains above the 0.9533-53 area (November/December lows and the 100 day MA), the buyers should be happy to buy on dips.

Fundamentally, on Friday, the CPI data for the month of February will be reported. The estimate is for a 0.0% MoM and -0.6% YoY. In the US, the market will be gearing up for the employment data.

With the peg gone in the EURCHF and the EU getting ready to embark on QE, the flow of funds have been more into Euro bonds (front running the ECB) and into the EU stock markets (the Eurostoxx is up 12.8% for the year while the Swiss Market index is down -0.32%). That combination, has helped take safe haven flows away from the CHF and allowed the currency to weaken naturally (with a little nudge by SNB rate cut fear/jawboning). Now that the price is above the 100 day MA and November/December highs, there may be even more room to extend higher. Watch for dips to continue to find bids.