Oil prices. Weaker trade and employment. Pair trades at the highest level since June 2004

Friday saw the Canadian employment and trade data show more weakness than strength. Sure the employment weakness was offset by a rise in full time employment. However the unemployment rate did rise to 7.1% from 7.0% and total jobs fell 35.7K.

Meanwhile, the trade data was not healthy as exports to the US were weak once again. With the CAD dollar lower and the US growth steady and higher, the Canadian economy is not taking advantage of this dynamic. Of course, oil prices are still a difficult headwind and the further plunge in prices today (Crude oil down over 4%) have finally led to a surge higher in the USDCAD (loonie weakness).

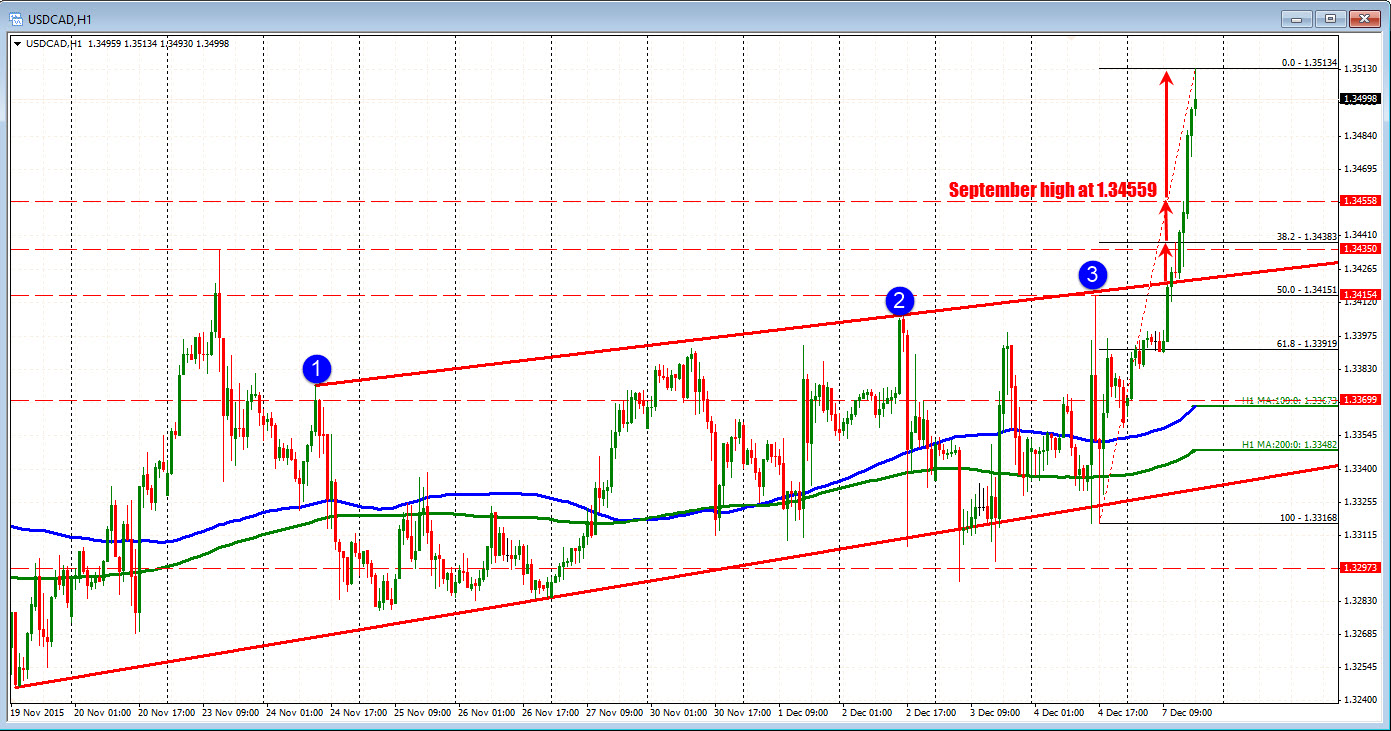

Technically, that momentum started to accelerate when the price extended above a trend line high and continued that momentum on the breaks of both the November highs at 1.3435 and the September highs at 1.34559.

Look for traders to now use that September high as support at 1.34559. .

Looking at the monthly chart, the USDCAD has also moved above the 61.8% retracement of the move down from the 2002 high to the 2007 low. That level comes in at 1.34685. That level may also be a close support level for traders today.