Attacking the Currency Non-Trend

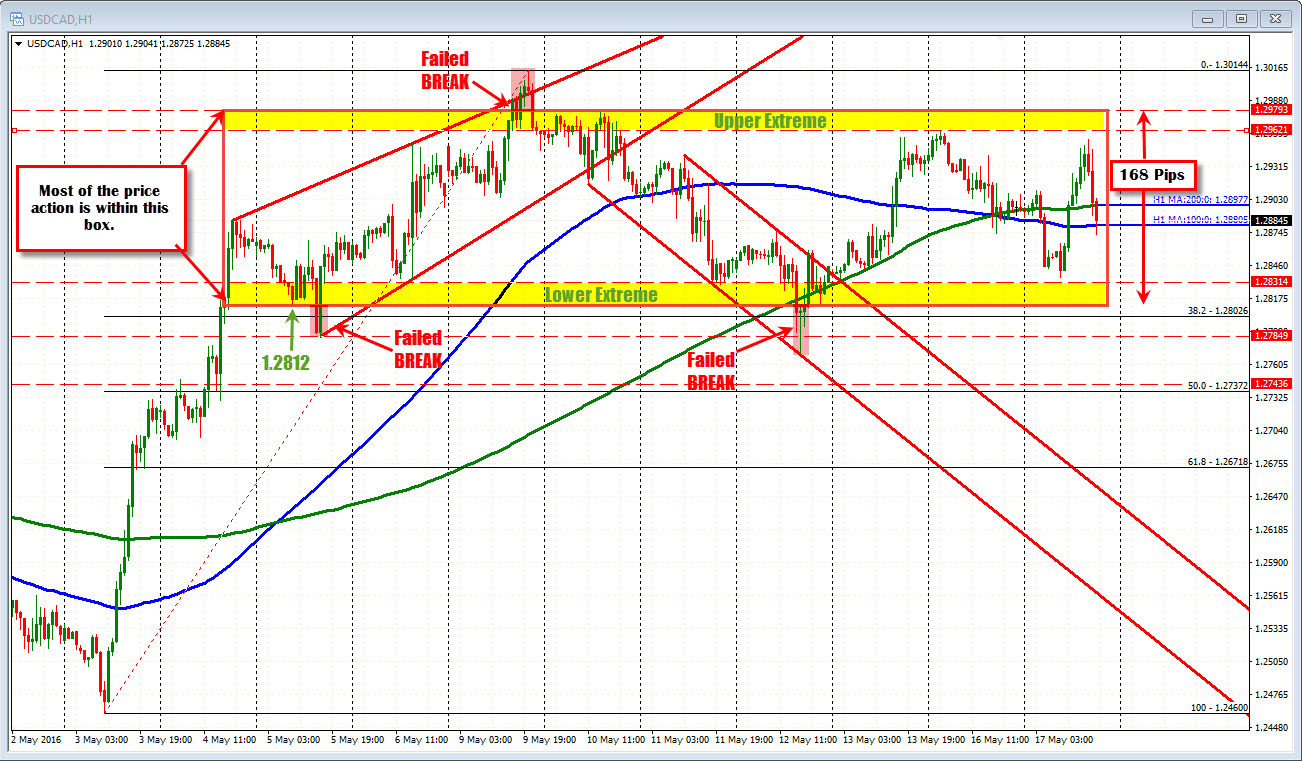

The USDCAD is a currency pair that is non-trending. Over the last 9 or so trading days, the price has:

- moved higher (ending a rend move on a failed extension above the topside trend line on May 9th).

- Moved lower and failed on an extension below the 200 hour MA (green line in the chart above).

- Moved to a high short of the ceiling at 1.2979 (the high got to 1.2962).

- Today we have see a rotation to a low near what I consider the lower extreme area at 1.2812-31 and a high near the upper extreme at 1.2962-79. The low reached 1.2836 and 1.2955.

- The inside trading range is 168 pips over. There have 7 hourly bars that have closed outside the extremes on the 3 failed breaks.

The market is trying to find the catalyst to make the break and run from the current trading range. In the meantime traders are leaning against low and high support and resistance levels.

Note the 100 and 200 hour MA are near the middle of the trading range. They have done a fairly good job at defining bullish or bearish risk/bias, but the price can continue to go above and below - chop around. We are looking to break below currently (at 1.2880) and that would switch the bias more to the downside.

Traders will likely continue to lean against the lower and upper extremes as it is at the extremes where the market is the least choppy. If you want to play a break and avoid the up and down, wait for the break. At some point there will be a break and run. Be aware for a fail, but that is the risk of trading.

If you want to view my video on Attacking Currency Non Trends, click here.