Crude oil higher helps CAD despite high build in inventories

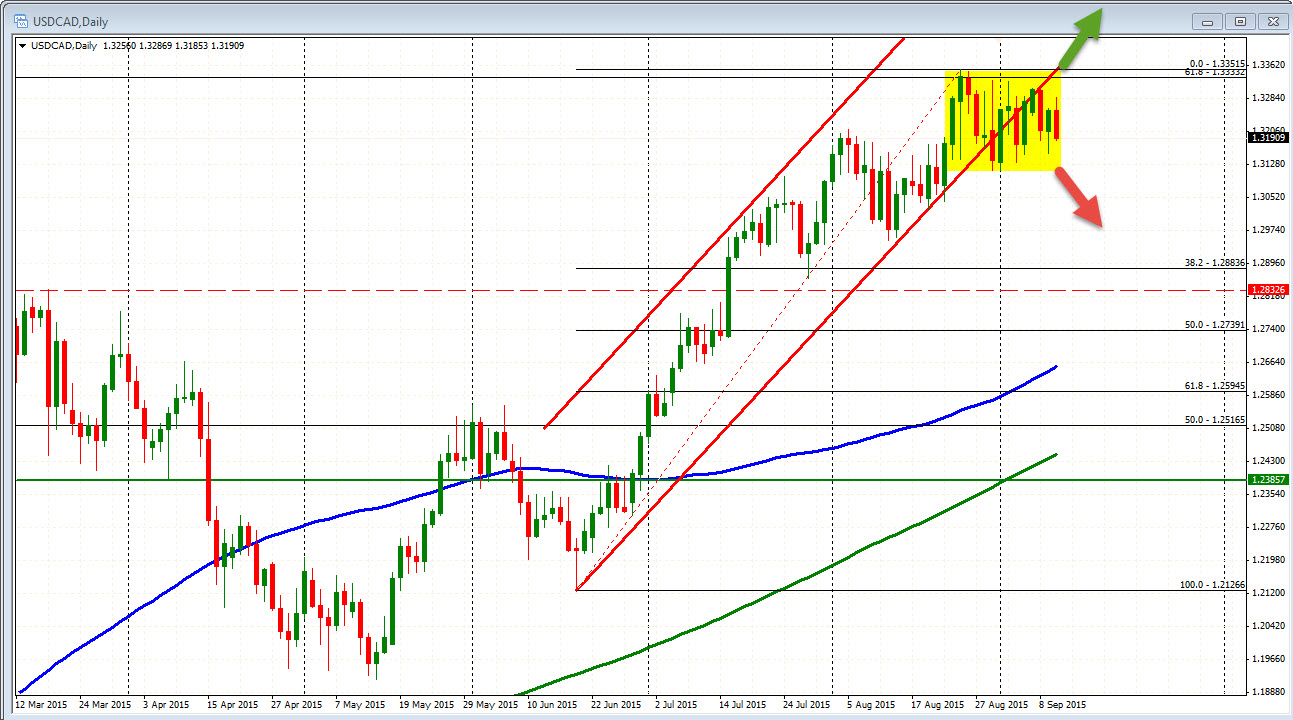

The USDCAD's up and down trading continues today. The pair first ventured lower and tested lower trend line support (we will ignore the break on the BOC decision yesterday) and then rallied toward the Asian Pacific highs, before moving back down in the North American session. Crude oil futures for October delivery currently trading at $45.70 up 3.51%. This despite a larger than expected build inventories. This is helping to contribute to the softer USDCAD (higher CAD).

Technically, the pair is back down testing the low trendline at 1.3187. The low for the day came in at 1.3185. So this is a key test level for the USDCAD. Traders looking for a dip can buy with stops below.

The pair has been pushed up and down which suggests being patient and trading at extremes. Are the converging trend lines extremes? Sort of. Traders know that if a support line that has 6 or so tests (and one big failed break that went to the next target) holds, that will catch the attention of other traders who likely SEE the same thing (maybe traders who see this post will jump on board too).

Traders also know if it breaks, there may be more probing in the direction of the break. Look for momentum For this pair, that means another test of the lows from Sept 3 and Sept 8th.

That is ok as traders can define and limit their risk. They can also jump on the next move should there be a break (or if it holds). How do you feel? Do you have a strong feeling? Or do you just want to stay away and wait for a bigger confirmation. After all, this is what the daily looks like.. There will be a break out of this range at some point.

We know the market is wonky, and that means being patient (or maybe even staying away). If you do put a toe in (either buying a dip or selling a break right here, you will need some momentum confirmation.

So keep an eye on break and momentum, but another eye on a break and run to support buyers.

Wonky.