Trades at the session lows

The NZDUSD this week moved higher after the RBZN kept rates on hold in trading on Thursday. The price moved just above topside trend line resistance at 0.7238 (the high reached 0.71469). The 61.8% of the move down from the April 2015 high was also broken. That came in at 0.71258. The price came off both those levels on Thursday.

Today the price tried to move back higher but stalled ahead of the 61.8 line at 0.71258. That helped to turn the tide and the price has moved lower.

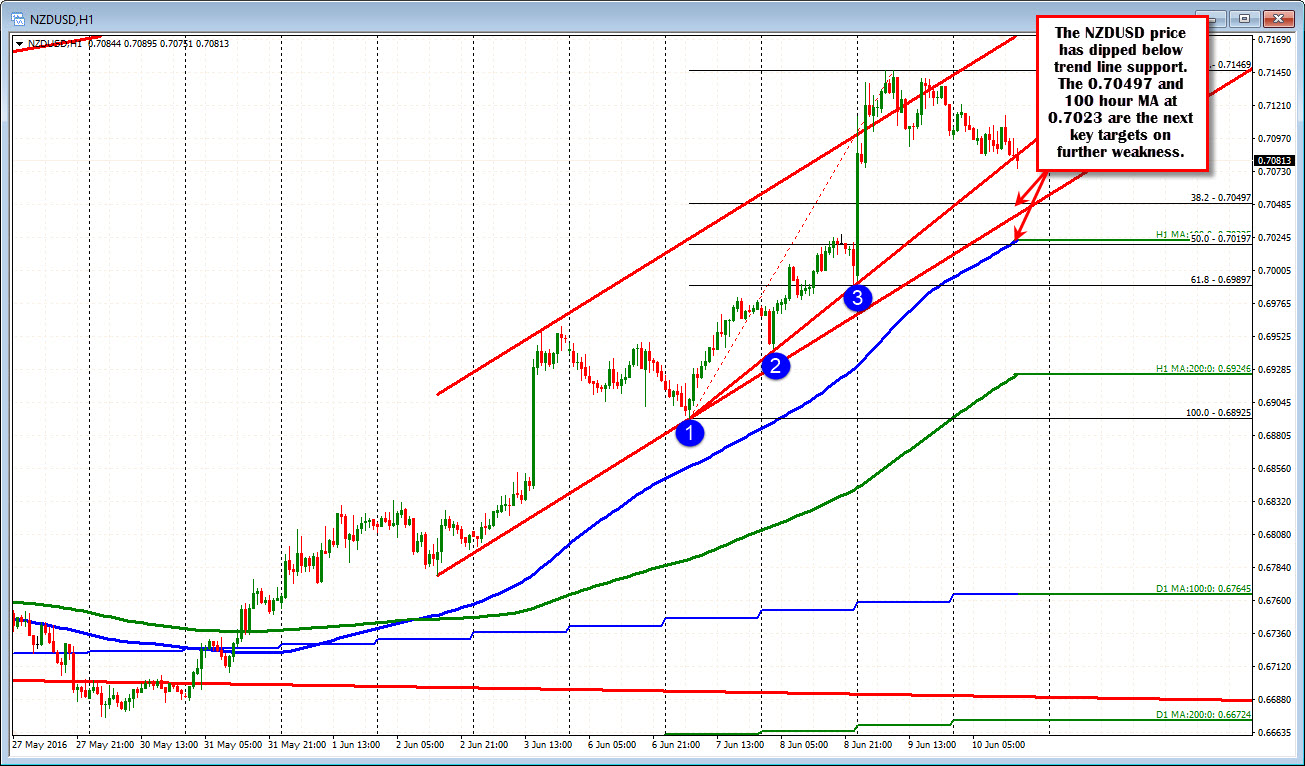

Looking at the hourly chart, the price is dipping below trend line support at the lows. The 38.2% of the move up from the weeks low comes in at 0.7059 area. The 100 hour MA is at 0.7023 those would be targets on a further correction.

The topside stall area seems to be an area that traders feel comfortable taking some profit. To go materially lower, traders will either need to start believe a cut is coming or the USD will rebound (from Fed). Some commodity weakness would also help (the CRB index is down 0.56%).