Not much changed over the last 24 hours.

The NZ Retail sales report will be released at 6:45 PM ET/2245 GMT with the expectations for a QoQ change of 1.0%. The core value is expected to show a 1.1% rise.In the 4Q, each rose by 1.2% and 1.4% respectively.

What levels are in play for this pair.

Honestly, I produced an video on the pair before the close yesterday and the same levels remain in play (see video here).

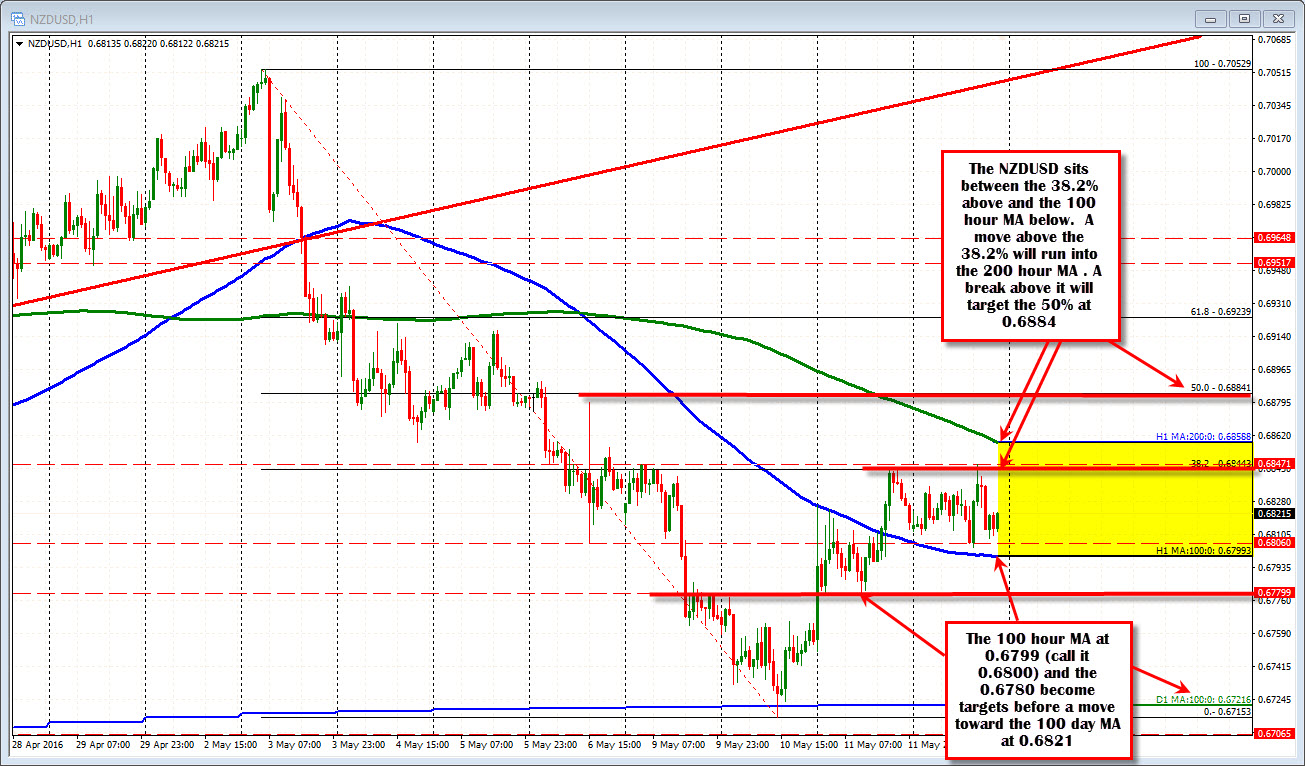

ON a stronger than expected number,a move to the topside will need to battle with the 38.2% at the 0.6844. This remains a key level to get to and through. The high today peaked a few pips above that level (the high today made it to 0.6847). Yesterday the high was pretty much right at the level. SO no surprise there that the pair needs to get above that level. ON a move above, the resistance does not stop. The 200 hour moving average currently comes in at 0.68588 level. That too should attract selling interest (at least on the first test).

If the number comes out weaker than expected, traders will likely push the price below the 100 hour MA (blue line in the chart above) at the 0.6799 level (lets call it 0.6800). the 0.6780 level is the next downside target. A move below it and the 100 day MA will be the level to go for at the 0.67216 level. ON Tuesday - before the RBNZ financial stability report, the pair bounced off this key moving average level