Moves below the month's midpoint

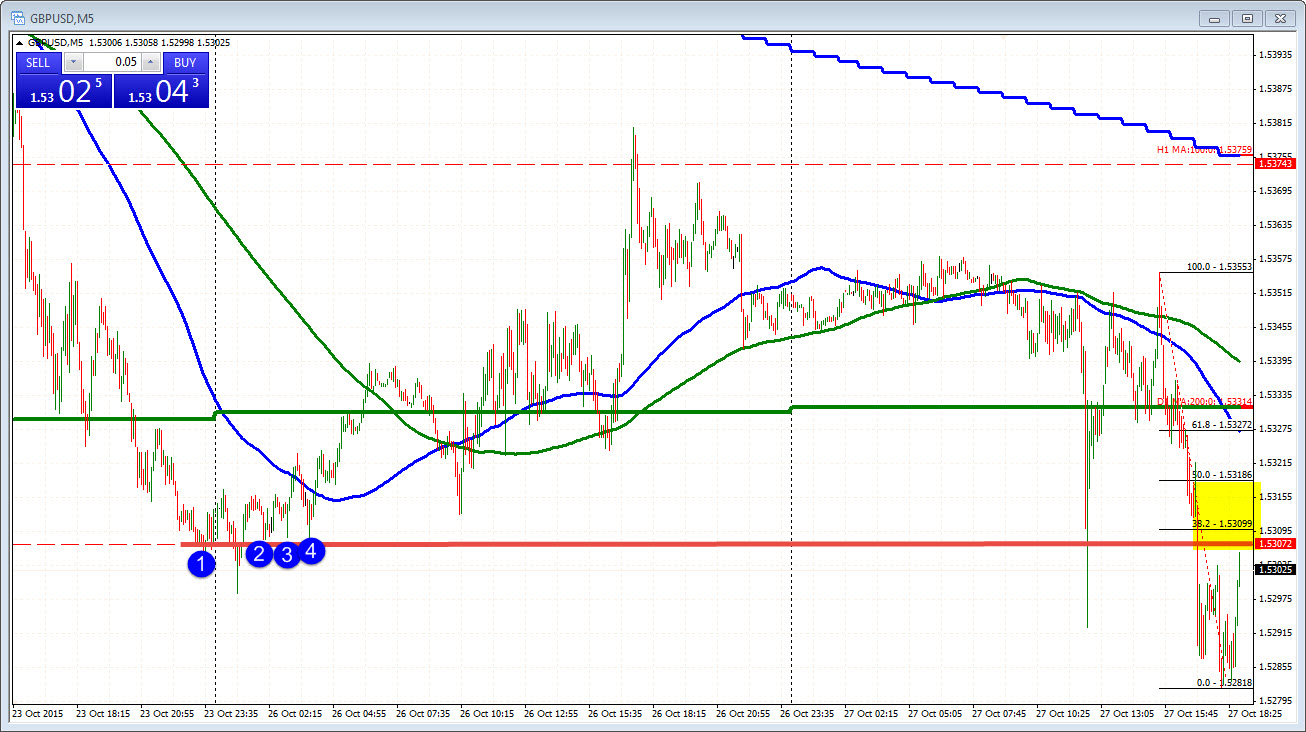

The GBPUSD is trading at new session lows in the last hour or so of trading and in the process moved to and through the month's 50% retracement level at 1.53072 (for the 2nd time today). The next targets on the pairs bearish path (that is IF the bears can keep control) would look toward 1.52598 (61.8%), the October 13 low at 1.5200 and then 1.5156-88 where there were swing lows in June and September. Most of the trading going back to May occurred above this area. There was a 8 day period in Sept/Oct. where 7 of 8 days traded above and below that floor but it failed to ignite a move below the 1.5100 level (or get close to 1.5000).

That is a bigger picture view.

The look more closely view of the market shows some rough ups and down moves that has the effect of scaring the traders to the sidelines. Looking at the 5 minute chart below, the price volatility is most evident. As I type the pair has moved quickly to the upside and looks to test the 50% retracement level at the 1.5307 level. We should stay below this level (and the 38.2-50%) at 1.53099-1.53186, but given the price action, be careful.